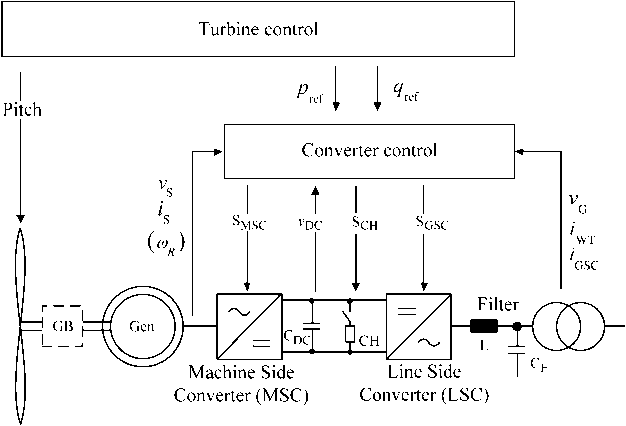

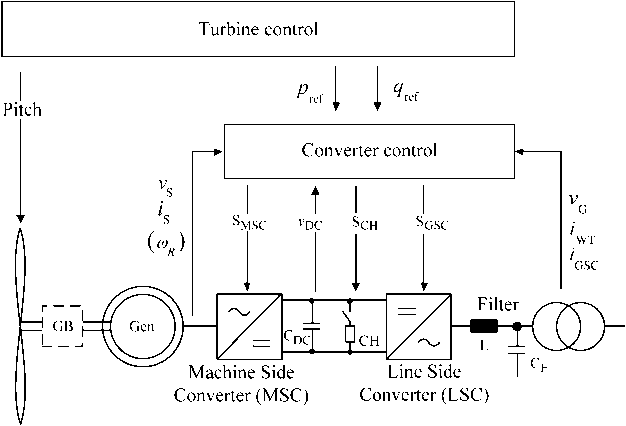

Fig. 4. Full size converter-based wind turbine with control variables.

This article has been accepted for inclusion in a future issue of this journal. Content is final as presented, with the exception of pagination.

INVITED

PAPER

Offshore Wind Power

Generation Technologies

By Istvan Erlich, Senior Member IEEE, Fekadu Shewarega, Member IEEE, Christian Feltes, Student Member IEEE, Friedrich W. Koch, and Jens Fortmann, Member IEEE

ABSTRACT | This paper provides an overview of the current state of the technology of offshore wind-based power generation and the technological challenges with emphasis on the electrical parts. First, a brief review of the core control functions, their correlation with operational behavior, and the gridsupporting capability of the machine during normal operation as well as during contingency situations are provided. This is followed by the discussion of basic considerations in wind farm collector design, including topology, grounding options, and outlay of the offshore substation. Then, issues related to offshore turbine foundation and typical dimensions of the offshore substation platform are discussed. The platform is designed to accommodate the main and grounding transformers, the switch gear, and other assorted accessories. Next, options for the transmission link from the offshore plant to the grid onshore are reviewed. Finally, a discussion of issues related to grid integration together with currently applicable special grid code requirements concludes the paper.

KEYWORDS | Collector grid; fault ride through; grid codes; offshore wind power; platform; voltage support; wind generator

Manuscript received January 26, 2012; revised September 10, 2012; accepted October 2, 2012.

I. Erlich and F. Shewarega are with the University Duisburg Essen, 47057 Duisburg, Germany (e-mail: istvan.erlich@uni-due.de; fekadu.shewarega@uni-due.de).

C. Feltes and F. W. Koch are with RWE Innogy, 22297 Hamburg, Germany (e-mail: christian.feltes@rwe.com; friedrich.koch@rwe.com).

J. Fortmann is with REpower Systems AG, 22768 Rendsburg, Germany (e-mail: j.fortmann@repower.de).

Digital Object Identifier: 10.1109/JPROC.2012.2225591

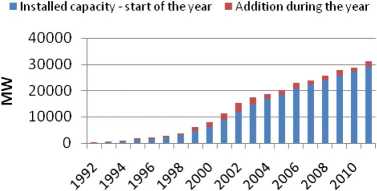

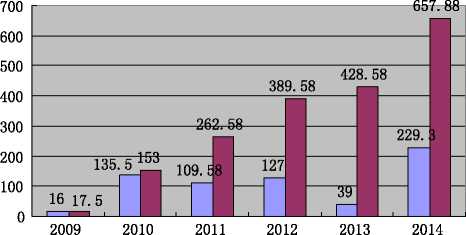

Fig. 1. Evolution ofthe installed wind generation capacity in Germany.

I. INTRODUCTION

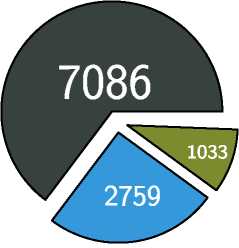

The rapid increase in installed wind generation capacity witnessed in the recent past has continued worldwide with undiminished vigor. This development is set to continue well into the future. By the end of 2010, the aggregate installed wind-based power generation in Germany reached 27 214 MW, and is projected to cross the 50-GW mark by 2020 [1]. Fig. 1 shows the progression of installed capacity over the last two decades.

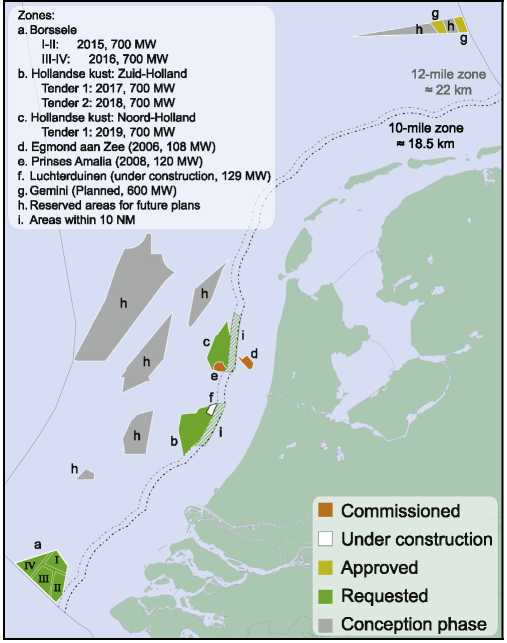

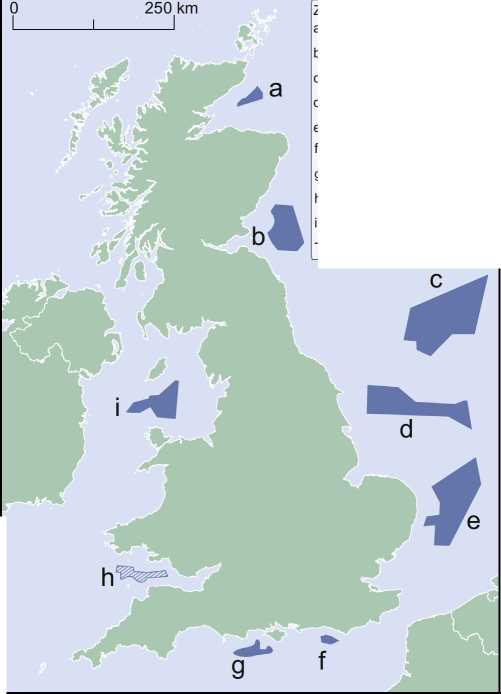

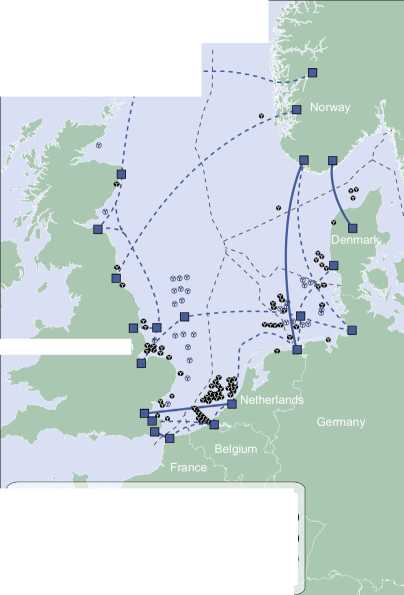

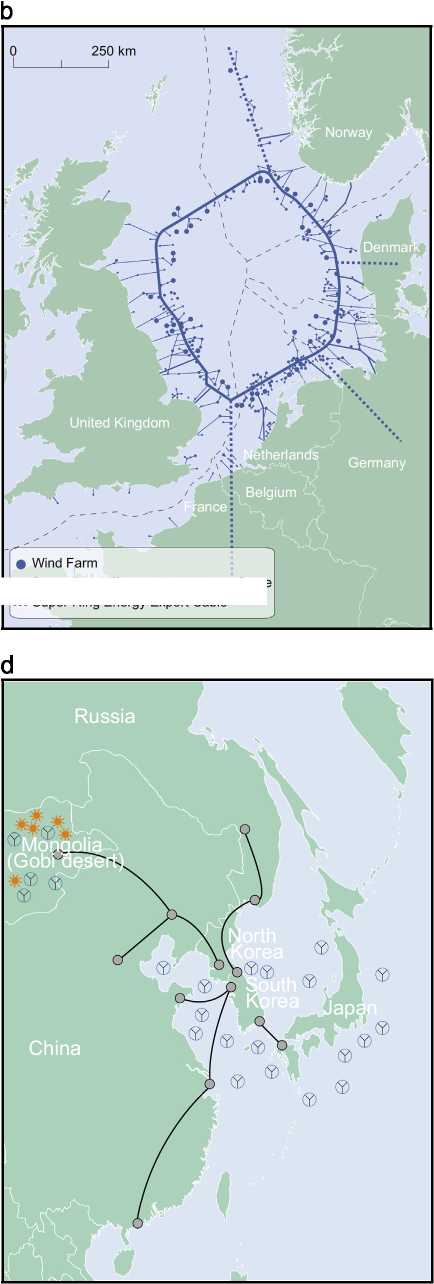

Another remarkable development to be observed starting from the mid-1990s is the increasing interest to locate wind turbines in the high seas. Offshore wind resources are vast. The wind energy potential in the seas of the European Union with water depths of up to 50 m, for example, is easily several times larger than the total European electricity consumption. Consequently, in addition to the current large number of onshore sites, many offshore sites are in the planning or implementation stages. Offshore wind farm capacity in the North Sea and the Baltic Sea (off the northern coast of Europe) alone is expected to rise to 20-25 GW by 2030 [1].

Shewarega et al.: Offshore Wind Power Generation Technologies

2001 2202 2003 2004 2005 2006 2007 2008 2009 2010 2011

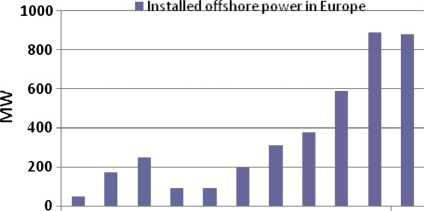

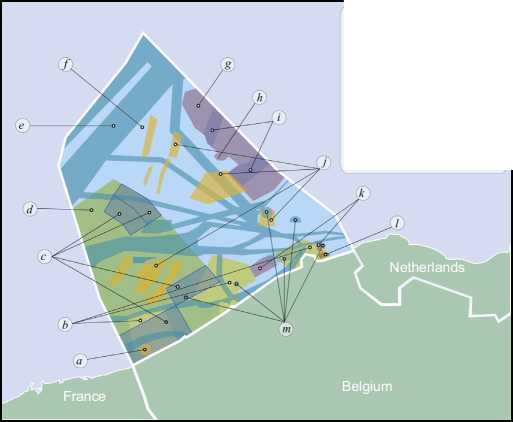

Fig. 2. Installed offshore wind power in the European Union.

Fig. 2 shows the evolution of offshore wind power capacity along the shores of countries in the European Union over the last decade. In the first six months of 2011, in total 101 new turbines with the overall capacity of 348.1 MW became operational, an increase of 4.5% compared to the same period last year [2]. In all, 11 sites were under construction during this period, with a total installed capacity of 2844 MW when completed.

Compared to the remarkably fast increase of onshore installations in the previous decade, these developments in terms of volume seem to be insignificant. But they are to be understood mostly as trial-balloon-type installations intended to gain insight into the operational challenges, and a significant increase in offshore capacity is already in the works. In Europe alone some 150 GW of offshore projects are already in various stages of planning [2]. According to [3], 25 offshore wind parks have already been approved outside the 12-nmi zone in the German areas of the North Sea and the Baltic Sea, and planning permission for further 50 projects has been applied for as of 2011. Other European countries also have firm plans for or have already started construction of offshore wind parks. Accordingly, offshore wind parks hold a huge promise for growth in the years ahead.

The basic technology and control concepts for a wind turbine are the same whether the turbine and its components are designed for offshore or onshore installation. The same applies to the overall process of layout design, which in both cases evaluates and compares configuration options in relation to the technical feasibility, overall capital cost, and the estimated energy production. However, the optimization parameters in offshore layout design, planning of the installation, and operational priorities vary significantly from those for onshore sites. For example, acoustic emissions which constitute an important consideration in onshore wind farm design are less relevant for the design of offshore projects. As a result, the turbine can be designed for higher tip speed ratio, thus enabling smaller turbine weight for the same energy output. On the other hand, offshore design places more emphasis on reliability since any necessary maintenance work is time consuming and constitutes a complex logistical operation involving the deployment of purpose-built ships and mobile gear. The vagaries of the high seas setting, which the components are exposed to, together with the operational objective of reduced maintenance requirement call for more robust material and equipment design and redundancy concepts compared to those used for conventional applications.

The evolution of offshore wind farm technology has come a long way from its early days in the 1990s. The turbines grew larger and are now capable of producing more energy per unit area. The costs of foundation and electrical infrastructure as well as the overall operational expenses have all decreased significantly. With the steadily maturing technology and the priority status accorded to renewable energy still remaining in place, there is a significant growth potential for offshore wind farms in the years ahead.

This paper intends to provide an overview of the overall technological challenges related to offshore wind-based power generation and the current state of the technology with emphasis on the electrical system and the associated control systems. The specific issues to be addressed include wind turbine technology with detailed overview of operational and control issues, wind farm collector grid design considerations, and finally issues related to grid integration together with currently applicable special grid code requirements.

II. WIND TURBINE GENERATORS

The generators employed in wind power plants are conceptually the same synchronous or asynchronous machines used for various other applications. As the generator is mounted at the top of the tower, the weight of a wind generator has much more significance than machines to be used for other applications. As a result, lower speed rating is desired so that the gear transmission ratio and thus the weight of the gearbox are as small as possible. It is also for the same reason that permanent magnet machines are continuously making headway in the share of the market. But with the cost of the raw material (rare earths) rising, it is not clear in which direction the development will evolve in the years ahead. Apart from these requirements pertaining to dimensions of the machine, what is new in modern megawatt range wind turbine generator systems is the application of frequency converters. Accordingly, the defining feature of wind-based generation plants is the arrangement of the converters used in conjunction with the machines and in case of offshore wind farms the location itself and the connection to shore.

The two most popular alternatives used for megawatt range turbines are the doubly-fed induction machine (DFIM) in which the stator terminals are directly connected to the network while a back-to-back frequency converter provides the controllable voltage to be fed to the rotor terminals, and a full-size converter machine (FSCM) in which a synchronous or squirrel-cage induction

Shewarega et al.: Offshore Wind Power Generation Technologies

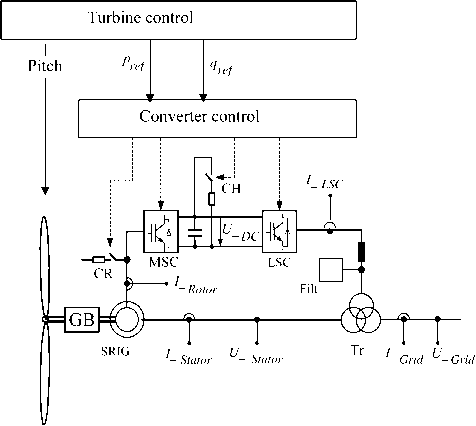

Fig. 3. DFIM-based wind turbine with control variables.

machine is connected to the gird via a converter designed for the full turbine rating.

A. The Doubly Fed Induction Machine (DFIM)

The DFIM is still the most commonly encountered machine in modern large turbines, although this may change in the future. A typical layout of a DFIM system including the measured values for control and protection is shown in Fig. 3.

Since the back-to-back converter is connected to the rotor circuit, obviously it has to be rated only for the maximum rotor power, which in turn depends on the desired speed range (about ±30% around the synchronous speed). The so-called rotor crowbar is used to protect the machine side converter (MSC) against over-currents during abnormal system conditions. When a contingency situation causes crowbar switching, the rotor terminals are short-circuited through the crowbar resistors. The MSC itself remains blocked for the duration of crowbar activation. The flipside of this protective measure is that it causes the machine to resort to an ordinary singly-fed induction machine and thus to become uncontrollable. On the other hand, transmission system operators impose certain performance requirements (grid codes) on the wind turbine vis-a-vis their performance in grid operation both during and in the aftermath of the fault. Depending on the stringency of the applicable requirements, even a short-term loss of controllability can make fulfillment of these stipulations impossible [4]. To forestall crowbar ignition (and, thus, retain machine controllability for most fault scenarios), the current trend is to insert a chopper in parallel to the direct current (dc) capacitor, leaving the crowbar only as a backup protection. When the dc voltage exceeds a preset value, the chopper switches a resistor (in parallel to the capacitor) to limit the dc voltage thereby preempting the need for crowbar activation. A similar operational behavior can be achieved by using active crowbars in which—as opposed to thyristors used in ordinary crowbars——insulated gate bipolar transistor (IGBT) switches are used.

In multimegawatt machines, the wind turbine-generator system is typically connected to the grid via a three-winding transformer. The line side converter (LSC) is connected to the low-voltage side (< 1000 V) of the transformer, while the terminal connected to the stator of the machine can have voltage values of up to 6 kV. The arrangement (i.e., the use of lower voltage) reduces the cost of semiconductor devices/converters used.

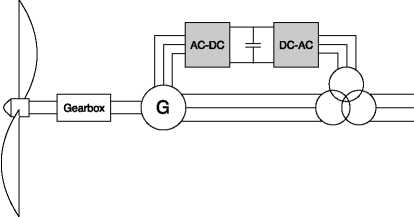

B. Full-Size Converter Machine (FSCM)

The salient feature of the FSCM is that it is connected to the grid through a converter with the full machine rating. The generator to be used with the full-size converter can be of a squirrel-cage induction machine (SCIG) type or a synchronous machine. In case of the synchronous machine, there is the option of electrical or permanent magnet excitation. If the electrically excited synchronous machine is used, the MSC can be replaced by a more economical passive rectifier and the generator is controlled through a dc/dc converter providing the rotor excitation and another dc/dc converter in the dc circuit (between the back-to-back converters) [5]. In case of the permanent magnet synchronous generator (PMSG) and SCIG, the MSC is a fully controllable converter based on selfcommutated semiconductor devices.

FSCM-based wind turbines (WTs) contain a braking chopper in the dc circuit (similar to the DFIM) to dissipate the generated power during grid faults. The series inductor and the filter are required for harmonic suppression and power quality improvement.

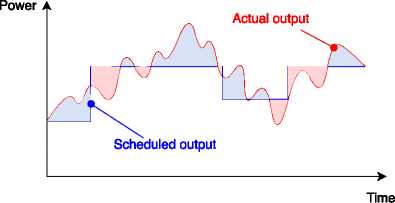

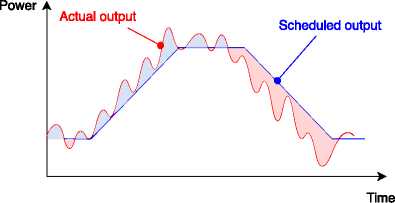

III. WIND TURBINE CONTROL

The two core control functions in a wind turbine are the pitch-angle and converter controls [7]-[13]. A combination of the two enables variable speed operation over a wide range of wind speeds, which is essential for the efficiency of the aerodynamic energy conversion process in wind turbines (see Fig. 4). Additionally, the control and protection functions of the converter ultimately determine the operational behavior of the wind turbine in grid operation, not least its grid supporting capabilities during contingency situations.

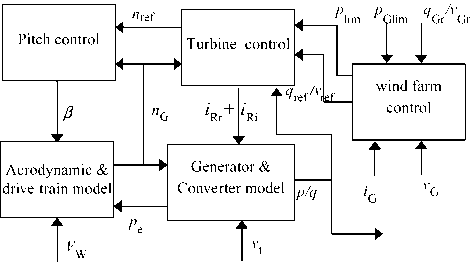

A. Overview

Fig. 5 summarizes the major control tasks in a wind turbine/farm together with the inter-linkages between them. The nomenclatures of the variables used in the figure (respectively) are as follows: vt; vG; vGr; and vref are the turbine terminal, the turbine reference, the grid, and grid reference voltages, respectively; p; piim; pGlim; and pe

Shewarega et al.: Offshore Wind Power Generation Technologies

Fig. 4. Full size converter-based wind turbine with control variables.

are the turbine output power, the turbine power limit, the grid power limit, and the air-gap electrical power, respectively; q; qref ; and qGr are the machine output, the turbine reference, and the grid reference reactive power, respectively; iG ; iRr; and iRi are the grid current, the prescribed current (real part), and the prescribed current (imaginary part), respectively; VW; nG; nref; and 8 are the wind speed, the generator speed, the reference rotational speed, and the pitch angle, respectively.

The core control functions are contained in the block ‘‘turbine control,,, which receives the reactive power setpoint (or, alternatively, the voltage set-point) from the operational control of the wind turbine or wind farm in line with the requirements of the system. The aerodynamic, the drive train, the generator, and converter blocks represent the mathematical models, which usually are put together in the form of a system of equations. The turbine control and pitch control blocks are the subject of detailed discussion in the following sections.

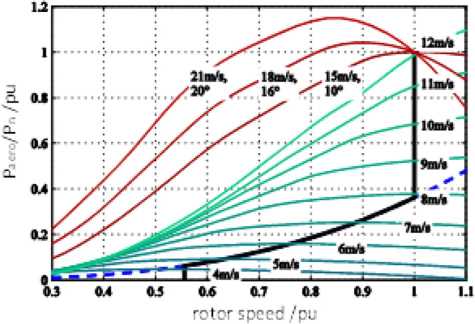

B. Pitch-Angle Control and Tracking Characteristic

The objective of the pitch-angle control is to limit the output power of the wind turbine and speed to a specified maximum value, when the wind speed increases beyond the design value by pitching the turbine blades out of the wind. This action reduces the mechanical stress on the wind turbine and the drive train.

A wind turbine can extract the maximum possible power corresponding to a given wind speed (within the allowable operational range) only if it runs at a specific speed. This performance requirement is met by controlling the electromechanical generator torque across a wide range of wind speeds in such a way that the operating points approximately match the tracking characteristic of the turbine, i.e., the rotor speed corresponding to the maximum power for each of the wind speeds in Fig. 6.

Fig. 5. Outline of the overall wind turbine control structure.

Fig. 6. Tracking characteristic of a DFIM-based WT.

Shewarega et al.: Offshore Wind Power Generation Technologies

However, as can be observed in the figure, the practical generator speed control range is rather limited. For example, for multimegawatt wind turbines the range is from the power corresponding to the cut-in wind speed up to approximately 40% of the rated power.

With further increasing wind speed, the generator speed is maintained constant at its nominal value and the power is allowed to increase up to the nominal value. The margin between nominal and cutout wind speed is chosen large enough to avoid generator overspeed tripping due to strong wind gusts or in case of a grid fault. To limit the dynamic overshoot of the rotor speed, the torque is maintained constant above the nominal generator speed, leading to increased electrical power, which counteracts the mechanical acceleration of the turbine due to higher wind speed.

C. Converter Control

The frequency converter allows the control of active and reactive power independent of one another. While the reactive power control is dictated by the need to maintain acceptable voltage profile in the system, active power is determined by the primary source of energy——the wind speed. Variable speed operation of the wind turbine over a broad range of wind speeds is required so that the wind turbine extracts the maximum power from the wind. Accurate measurement of wind speed in the vicinity of the nacelle is difficult due to turbulence. As a result, measured power is used to determine the speed set-point using a lookup table in which the tracking characteristic of the turbine is stored.

The MSC and LSC controls in both the DFIM and the FCSM have distinct control tasks, which makes separate consideration of the two necessary.

1) MSC Control: Common to both the DFIM and the FSCM is the fact that the turbine speed control is responsible for regulating the turbine speed for maximum power generation in accordance with the tracking characteristic in part load mode (via the converter control) and limiting the power to the rated value during periods of high wind speed (via the pitch-angle control). Additionally, the reactive power output (or, alternatively, the power factor or voltage) is controlled in line with system requirements. In the DFIM, the outputs of the real and reactive power controllers are the rotor current set-points, which in turn are inputs to the underlying current controllers. The current controller then determines the rotor voltage to be generated by the MSC so that the control objectives are achieved. In the FSCM, the stator current set-points are generated by the power controller, which in turn adjusts the stator voltage.

2) LSC Control: The task of the LSC controller is to maintain the dc link voltage at the prescribed value and to support the grid with reactive current injection during grid faults and also in steady state if and when the need arises. In a rotating reference frame, in which the direct axis is aligned to the positive sequence terminal voltage, the direct (d) axis current corresponds to the active current, and the quadrature (q) axis current corresponds to the reactive current. It can be shown in some simple steps that the d-axis current can be used to control the dc voltage and the q-axis current can be used to control the reactive power independently of one another. The output of the dc voltage controller and the reactive current corresponding to the reactive power reference serve as reference values for the underlying current controller.

In the FSCM, the reactive power has to be provided in full by the LSC, whereas the DFIM offers the option of using both the LSC and the MSC to provide the reactive power during fault and also in steady state.

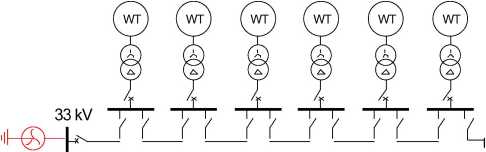

IV. ELEMENTS OF THE COLLECTOR SYSTEM

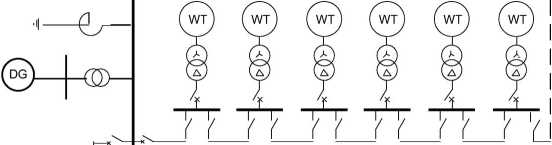

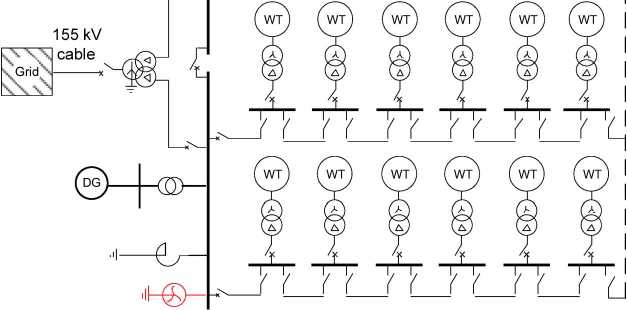

An offshore wind park, depending on its size, may contain a large number of turbines spread over an area of tens of square kilometers. Each turbine-generator set is directly connected to a step-up transformer, which is referred to as a turbine transformer. This transformer according to the current practice is connected Dyn (or Dynyn for the DFIM). Medium - voltage sea cables then link the turbine formations to the offshore substation. The platform additionally accommodates the compensation reactor, the standby diesel generator set, and the grounding transformer (see Figs. 7 and 8). In the following paragraphs, these components will be reviewed briefly.

A. A Standby Diesel Generator Set

Contingency situations can cause loss of connection to the grid onshore and force the offshore system into an island operation. Due to possible rough weather conditions, access to the site may be difficult and electricity supply interruptions for prolonged periods are possible. As

Fig. 7. Offshore substation platform Baltic 1.

Shewarega et al.: Offshore Wind Power Generation Technologies

Fig. 8. Offshore platform.

B. Medium-Voltage Compensation Reactors

The medium-voltage cable network can produce a sizeable charging current. In an island operation, this charging reactive power would need to be supplied by the auxiliary diesel set. With the capacitance values in the range of 0.2-0.4 〃F/km, the charging reactive power can easily exceed 6 Mvar. In order to be able to size the backup diesel generator set for the auxiliary load only, compensation reactors are placed at the platform bus. It is also possible to use STATCOM instead of reactors if the dynamic response of the wind turbine system is found to be unsatisfactory, in which case the STATCOM may take over the fulfillment of some of the performance requirements from the wind turbine control system. The advantage of fast response and the possibility of adequate reactive power generation even at very small voltages come at a cost of higher initial investment. The overall reliability of the system may also be affected adversely.

a result, offshore wind farms are equipped with diesel generator sets to cover the auxiliary load and to keep all essential equipment such as climate conditioners, control and safety systems operational during these periods. The loads are fed through the tertiary winding of the wind turbine transformer or directly from the medium-voltage system using a dedicated transformer [23].

C. Grounding Transformer

Commercially available standard wind turbine transformers are of Dyn5yn5 type [35], and the step-up transformer at the collector bus, as shown in Fig. 9, is delta connected on the 33-kV side. The necessary high level of reliability calls for the network to be effectively grounded [12]. Effective grounding offers the benefit of fast fault

Fig. 9. Wind farm collector system/double-sided ring configuration.

Shewarega et al.: Offshore Wind Power Generation Technologies

detection (in less than 150 ms) and the possibility of selectively clearing the fault, in addition to limiting the overvoltage in phases which are not directly affected by the fault. The fast fault clearing limits the thermal stress at the fault location from reaching dangerous levels. The unavailability of standard equipment for effective grounding necessitates the use of additional grounding transformers, which facilitate the fault detection capability of the protection system during single line to ground faults and limit the maximum voltages in the healthy phase. They are usually connected to the medium voltage (MV) collector buses and located on the main substation platform.

D. Medium-Voltage Cable Network

There are a number of options for the configuration of the cable links to the offshore substation at the platform [22]. The basic consideration involves striking the optimum balance between reliability on the one hand and the cost of for the collector network on the other hand.

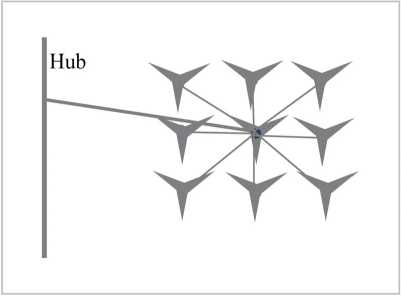

1) Radial and Star Topology Options: The simplest arrangement for the collector system is the radial design in which a group of turbines are connected to a lateral feeder string. This arrangement enables the use of a simple protection concept, easier control possibility, and the shortest possible cable run. Since the current in the feeder away from the hub decreases, a tapered cable cross section—— with the largest at the hub end and the smallest at the farthest end of the feeder——can be used (thus reducing the overall cost of the cable). This topology was used for the 160-MW Horns Rev offshore wind farm in Denmark, which is the first large-scale offshore wind park [20]. The major drawback of this design is its poor voltage regulation and reduced reliability as cable or switchgear faults at the hub end of the radial string have the potential to force all downstream turbines out of operation.

Both the voltage regulation and reliability problems can be improved by using the star configuration [22]. In the star topology, each turbine within a group or formation is directly connected to the hub, as shown in Fig. 10, and, as a result, a single cable outage in general affects a single turbine alone. The disadvantage is the longer cable runs and the need for a higher rated cable for the short sections, which conduct the combined current of the formation to the hub. Another disadvantage is the complex switchgear arrangement at the center of the star.

Fig. 10. Wind farm collector system——star topology.

thus achieved at the expense of using more conductor material. In the double-sided loop, the basic configuration during normal operation remains radial. But the cable strings are equipped with provisions to convert the radial strings into a loop structure in contingency situations, as shown in Fig. 9, with the objective of keeping as many of the turbines as possible operational in the event of internal fault, thus addressing some of the system security issues arising from the radial design. The additional security comes at the expense of longer cable runs for a given number of wind turbines, and higher cable rating requirements throughout the string circuit.

In the example shown in Fig. 9, all 24 DFIM-based turbines have a rating of 6 MW and the generator transformers are Dyn5yn5 connected (although only two of the windings are shown in the figure for clarity). The turbines are grouped into two clusters. A 33-kV intrafarm cable network interconnects the turbines within each group to one another and then to the collector bus. Each section of the collector bus is connected to the two low-voltage terminals of the main three-winding transformer at the hub having the vector group Ynd5d5. A 155-kV submarine cable finally links up the wind farm to the grid onshore. The short circuit impedance across the two low-voltage terminals of the transformer is chosen relatively high to reduce the effect of internal faults in one part of the WF on the other unaffected part.

In [17], the topology of a wind farm consisting of 48 turbines (which is currently under construction) is given. The configuration of the collector system is almost identical with the one given in Fig. 9, which gives rise to the assumption that this topology represents the currently preferred option for an offshore wind farm. In both cases, the voltage level of the collector network is 33 kV. Typical cables in use are 240-, 630-, and 800-mm1 aluminium cables [17]. The cable cross section is reduced toward the end of a string, with the section to the first wind turbine generator (from the hub) being 800 mm1, to the second and third 630 mm1, and the last three cable sections 240 mm1, and the power rating of the string is approximately 22 MW.

Shewarega et al.: Offshore Wind Power Generation Technologies

The 155/33-kV transformer has a relatively small voltage control range, for example, ±13% in ±6 steps. As a result, the number of voltage regulation steps is limited.

E. The Protection System

An offshore wind park is obviously designed for unmanned operation, and all operational control functions are performed from a distance in an onshore location. Access to the site for a routine maintenance or emergency repair following a fault can take a long time. As an example, it is stated in [17] that access to the platform takes at least 2 h from the nearest island, 4-5 h from onshore under best weather conditions, and possibly several days in the worst case scenario. The costs arising from the level of complexity of the protection, therefore, need to be weighed against the effort it takes to access the fault location for manual intervention. The protection system, therefore, has to take this and a number of other salient features of an offshore wind park into consideration, in addition to being grid code compliant [14].

In the example shown in Fig. 9, each wind turbine generator-transformer set (WTG) is equipped with three remote controlled breakers (circuit breaker, disconnector, and earthing switch combination)——one breaker for the transformer and two breakers for the incoming and outgoing cable feeders. In case of cable fault, the section between the two transformers affected by the fault can be isolated and the rest of the system can operate normally via the ring connection at each end of a string. This leads to a flexible control and protection concept.

The protection concept presented here is based on [17], in which the protection system of 295-MW offshore wind park in the North Sea to be commissioned in 2013 is discussed.

The various protection and control devices at the different bays and transformers are connected in a ring configuration via optical fiber cables to a centralized control unit, and the communication between the different protection devices is based on the International Electrotechnical Commission (IEC) 61850 protocol. In this implementation, combined protection and control devices are used for the medium-voltage switchgears, and for the high-voltage switchgears, separate devices are used for each of the functionalities. All switching operations can be performed locally or remotely from an onshore location. These measures in combination are designed to reduce the downtimes and to guarantee the highest possible availability. The secure communication also allows a Generic Object Oriented Substation Events (GOOSE) transfer between the WTGs to enable certain functionalities/interlocks, and the downloading of the protection device status via the IEC 61850 protocol from onshore in case of a trip or maintenance.

The protection system types for the components of the wind park are as follows. The WTG transformer bus bars have a differential protection, while the transformers themselves are protected by overcurrent relays. All medium-voltage cables have a differential protection as the main protection and the distance protection as a backup protection. The compensation reactors connected to the 33-kV bus are equipped with the overcurrent protection, and the same applies to the 33/0.4-kV auxiliary transformer. The earthing transformer connected to the 33-kV bus has the overcurrent protection together with the earth-fault protection at its star point. The 33-kV bus bars are fitted with the bus bar protection with a separate field unit for each bus bar bay and one central unit for all bus bar segments with an integrated switch failure protection and an overcurrent protection. The high- and low-voltage windings of the main transformer have different protection schemes. While a differential protection is used on the high-voltage side with an integrated over current protection and control function, the distance protection with control function is used on the low-voltage side and the Buchholz protection as a backup. Finally, the distance protection with control function is used for the export cable linking the platform to the grid onshore.

F. Offshore Foundation and Platform

Offshore foundation and platform designs draw on the high seas experiences of the oil and gas industry. However, increasing interest on offshore wind power in the recent past and the resources available now for research mean that the technology is evolving on its own terms.

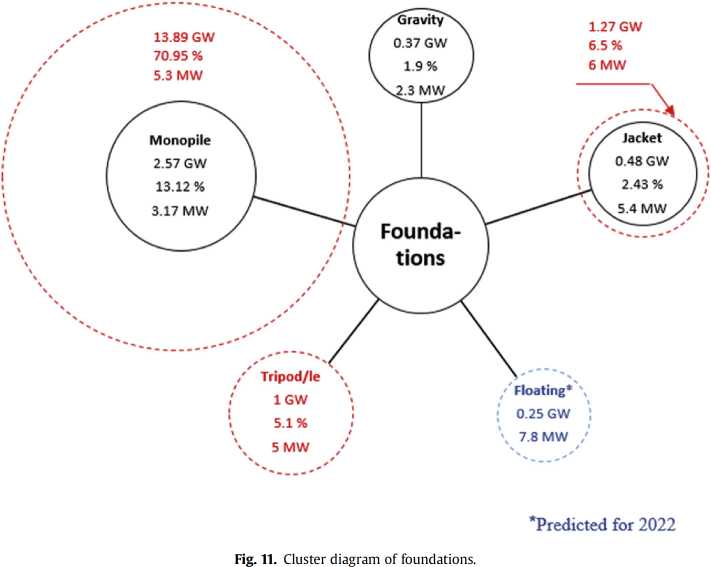

1) Foundation: The most common foundation types in use in the German waters as of now are the jacket and tripod foundations, but other types, particularly gravity foundations, can also be expected in the future [24].

The jacket construction is already established in the oil industry. Its foundation is based on a steel pipe support structure with special casts on its junction points [26]. The frame of a jacket is similar to the electricity pylon, and standard steel pipes from the pipeline construction industry can be used for the jacket, which is pinned to the sea bed with piles. The transition junctions connect the square jacket foundation with the round tubular steel tower of the turbine. Since the individual components are relatively small, its production, transportation, and installation are easy. One disadvantage is the need for a remote collision protection.

In the tripod design, a three-legged steel frame supports the main pile under water (see Fig. 11). The three legs of the tripod are pinned to the sea bed with three smaller piles hammered into the sea bed with the depth depending on soil conditions. This technology is deemed to be more suitable for higher water depths. The tripod foundation is not suitable for use on a stony sea bed.

In a gravity foundation, the turbine is supported by a big concrete block similar to those used in bridge foundations. Gravity foundations have been used at some

Shewarega et al.: Offshore Wind Power Generation Technologies

Fig. 11. A barge carrying tripod foundations being towed into position.

European wind farms for water depths of up to 10 m [3]. Cost reductions have been achieved by using different shapes. One advantage of this technology is that it is independent of steel price fluctuations. Therefore, it is likely that gravity foundations will find more and more use in deeper waters in the future.

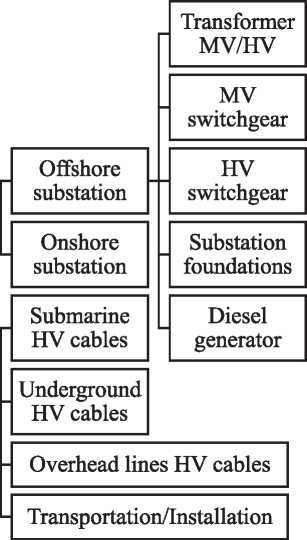

2) Offshore Substation Platform: Except for rare cases in which the distance to onshore is short, transportation of power to the grid connection point requires a high voltage and thus an offshore substation. As with the other offshore assets, size and weight are crucial design considerations. Additionally, limited accessibility and harsh environment mean that design approaches and redundancy concepts new to the power industry are required.

The platform is a massive structure that accommodates the main transformer, the compensation reactors, the high- and medium-voltage switch gears, the grounding transformer, and the standby diesel generator set. In terms of weight and size, obviously the transformer is the major component. To illustrate the magnitudes involved, the following is the data from a 300-MVA platform: weight of the platform foundation: 800 T, the combined weight of the structure and equipment above water: 2000 T, of which the weight of the steel structure alone is 950 T. In a new compact offshore substation, using gas-insulated transformers is introduced. The most significant design change is the elimination of insulation oil. A prototype offshore substation built around two gas-insulated (SF6) transformers with a combined power rating of 360 MVA is introduced in the above-referenced material. By eliminating the oil and with it the auxiliary systems such as oil tank, it is reported that significant reduction in the weight of the transformer can be achieved.

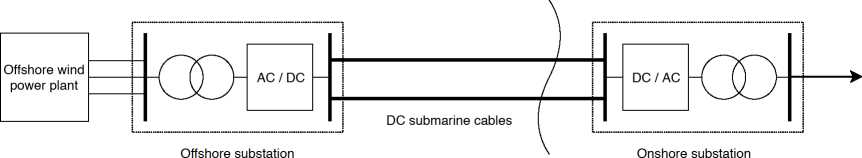

V. THE TRANSMISSION LINK TO THE GRID ONSHORE

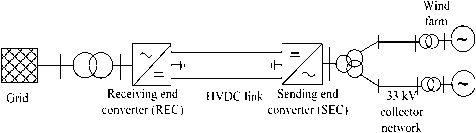

For the transmission of power from the offshore plant to the grid connection point, choice is to be made between high-voltage alternating current (HVAC) and high-voltage direct current (HVDC) based on line commutated converter (HVDC LCC), or voltage source-based HVDC (HVDC VSC) as part of the overall project planning process.

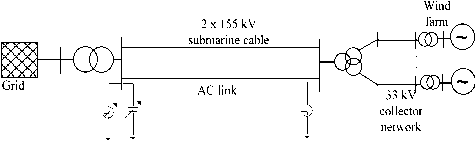

Alternating current (ac) connections are based on well-known and tested transmission and distribution equipment. However, the possible transmission voltage level is constrained by the charging current. There are also other limiting operational factors. For example, in [21], it is recommended that, in addition to the maximum permissible current, voltage regulation at the receiving end between no-load and full load should remain less than 10% and the phase-angle difference between receiving- and sending-end voltages should not exceed 30°. This limits ac interconnection through submarine cables to transmission voltages of up to 155 kV and a transmission length of up to approximately 100 km with compensation reactors in both ends. Cables of 245 kV are also available but are as of yet not in use.

As stated above, the charging reactive power is considered the main limiting factor in HVAC cable utilization in long-distance transmissions. The reactive power generated by the cables is compensated using shunt reactors connected directly to both ends of the cable. To avoid any unintentional connection of the cables without the compensation reactors, both cables and reactors are switched concurrently using the same switch. The reactor on the onshore side is continuously adjustable up to the full compensation (100%) of the charging current (the onshore side is chosen for control on grounds of ease of operation). But partial compensation offers a control capability using the remaining capacitive current. The maximum value of the current after compensation should not exceed the interrupting capability of the circuit breaker, which is relatively small and the charging current alone can under circumstances exceed this value.

HVDC transmission is likely to be the preferred option for future offshore wind farms. Conventional HVDC transmission using line-commutated thyristor valves has higher power rating and is capable of very high transmission voltage. It is also characterized by higher transmission efficiency. Due to the low degree of controllability, lack of

Shewarega et al.: Offshore Wind Power Generation Technologies

Fig. 12. WF topology with VSC-based HVDC transmission.

black start capability and the converter,s reactive power consumption, however, weak networks cannot be connected to this system.

VSC-based HVDC transmission, using self-commutated valves [IGBTs, integrated gate-commutated thyristors (IGCTs), and gate turn-offs (GTOs)], on the other hand, is available only for lower transmission voltage levels and power ratings. It is more expensive and has higher losses, which are related to the switching behavior and frequency of the self-commutated devices. However, there are also some significant advantages, which make it very suitable for the connection of large offshore wind farms, such as fast control of active and reactive power independently from one another, capability to support the system in major contingencies, black start capability, possibility of connection to weak or even passive networks, capability to reverse the power flow direction almost instantaneously, etc. Additionally, new soft-switching methods and higher level topologies for VSC-based HVDC can significantly reduce the converter losses and make this kind of transmission more economical and reliable. Fig. 12 shows a possible arrangement for an offshore wind farm link to the onshore grid using HVDC and Fig. 13 using HVAC.

VI. EXAMPLES OF OFFSHORE

WIND FARMS

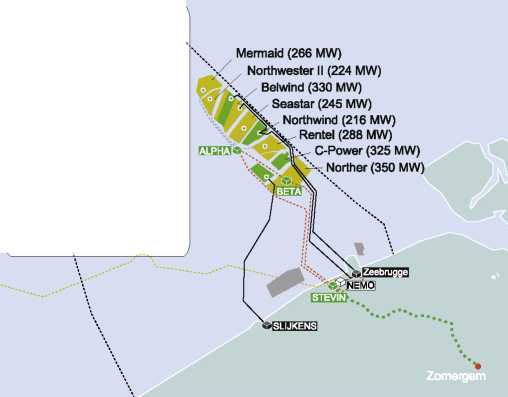

A. The Offshore Wind Plant Alpha Ventus

The wind park Alpha Ventus [25] is the first ever to be installed in Germany. It is located off the northern coast within the exclusive economic zone of Germany, and designated as a pilot project primarily intended for research purposes. The wind farm contains 12 turbines in all, each with a power rating of 5 MW, and is operated by a com-

Fig. 13. Offshore WF link using ac cable.

Fig. 14. Partial view of the Alpha Ventus offshore wind park site.

pany called Offshore Test Field and Infrastructure, which is established as a joint venture by the power companies EWE AG (47.5% share) and E.ON Climate & Renewables GmbH and Vattenfall Europe New Energy GmbH (each with 26.25% share).

Two types of turbines are installed: Multibrid M5000 (from AREVA Wind, Bremerhaven, Germany) and REpower 5 M (from Repower Systems SE, Hamburg, Germany) (see Fig. 14). The Multibrid turbine M5000 has the following data: hub height 85 m (above water surface), rotor diameter 116 m, cut-in wind speed 3.5 m/s, cutout wind speed 25 m/s, and rated power at or above 12.5 m/s wind speed. The gross weight of the nacelle including the wind rotors is 309 T, and the foundation, tower, and hub turbine platform together weigh about 1000 T. The substructure is designed for a life span of 60 years.

The characteristic data of the REpower turbines is as follows. The rotor diameter and the hub height are 126 and 92 m, respectively. The turbines are installed on a prefabricated jacket basement. The height of the jacket basement is 57 m, weighs about 320 T, and occupies an area of 17 m X 17 m at its base.

The turbines in the wind farm are clustered into groups of three to be connected to a transformer which steps up the voltage to 30 kV. A collector network then links all turbines to an offshore platform Alpha Ventus, which steps up the voltage to 110 kV, from which a 70-km-long submarine cable links the wind farm to the grid onshore.

Whereas the AREVA wind turbines stand on tripods, the REpower turbines are mounted on jacket foundations with a water depth of 30 m [21].

Shewarega et al.: Offshore Wind Power Generation Technologies

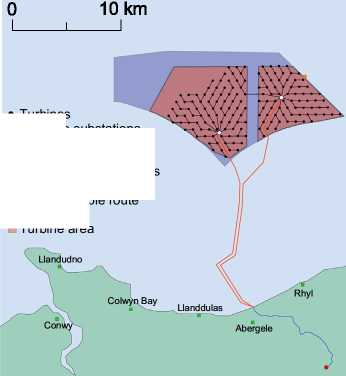

Fig. 15. Location ofthe HelWin cluster in the North Sea [28].

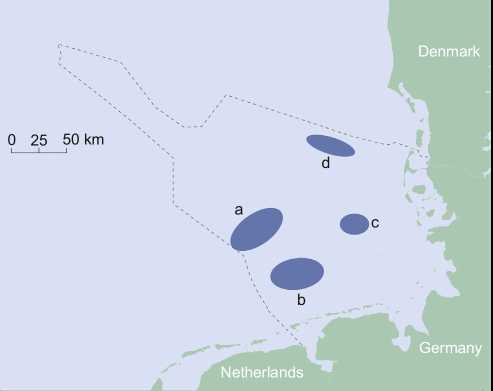

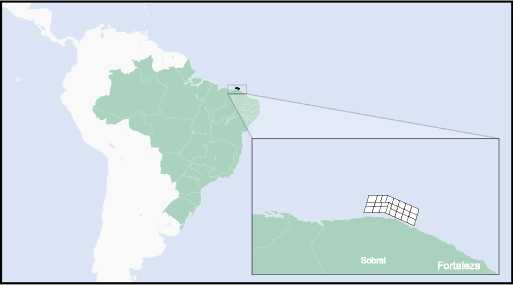

B. The HelWin Cluster in the North Sea

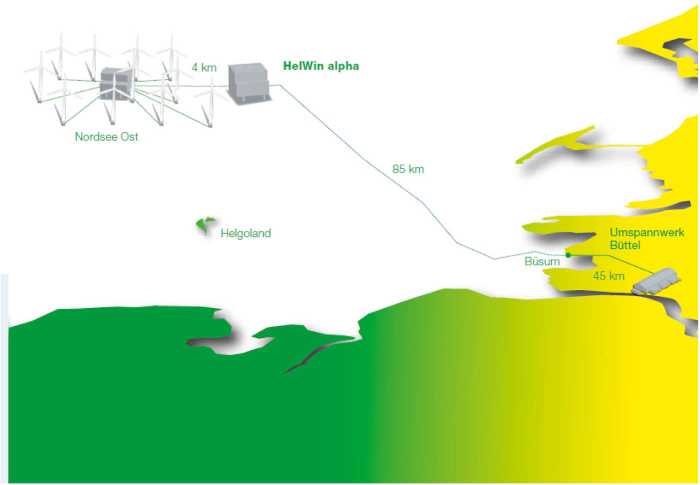

The HelWin North Sea cluster is a name given to a group of offshore wind parks currently under construction. The project site is located in the German exclusive economic zone in the North Sea at a distance of about 55 km from the mainland, 35 km north of the island of Helgoland, and 37 km west of the North Frisian island of Amrum (see Fig. 15). The wind farms North Sea East, Amrumbank West, and Meerwind make up the cluster.

One of the sites, the North Sea East (NSE), contains in all 48 REpower 6-M wind turbines spread over an area of 24 km2, with the overall installed capacity of 295 MW. The water depth ranges from 22 to 25 m. The site is scheduled to become operational in 2013. The 48 wind turbines are connected with each other using 33-kV interarray cables linking them to the substation. The substation platform weighs approximately 2100 T, and is mounted on a steel structure as a foundation which protrudes approximately 37 m above the sea level. The tower of the wind turbines has a length of70 m above the water level. The weights of the tower and the nacelle are 243 and 350 T, respectively. The turbine swept area has a diameter of 126 m, and the three rotor blades together weigh 125 T. Jacket foundations have been used also for the turbines, and the four pedestals are anchored with the sea bed using piles. Each of these foundations has up to 50-m height, weighs approximately 550 T, and the foundation pedestals occupy an area of almost 400 m2.

The other site in the cluster, offshore wind park Amrumbank West, is owned by Amrumbank West GmbH, a fully owned subsidiary of E.ON AG. In this site, in all, 80 Siemens 3.6-MW 120 wind turbines are to be installed over an area of 32 km2. The site is scheduled to start operation in 2015. The third site in the HelWin cluster is the Meerwind, which launched the project activities in August 2011. When completed, the site will have 80 Siemens 3.6-MW 120 wind turbines installed with the overall capacity of 288 MW. The Siemens turbines use monopile foundation. According to the current schedule the site is to be commissioned in 2013.

Connection to the main grid for all sites will be undertaken by the grid operator Tennet TSO GmbH, which awarded the contract for the construction of the link to onshore to Siemens. Siemens is responsible for turnkey supply of the fully equipped floating and self-erecting platform [30].

As stated above, the 33-kV medium-voltage cables converge on to the substation of each of the sites. The voltage is then stepped up to a transport voltage level of 155 kV, and from there ac cables link up the substation to the offshore converter platform, on which the Siemens HVDC Plus system for high-voltage direct-current (HVDC) transmission is installed. The first of the converter platforms to be completed is Helwin Alpha, which serves as a converter station for North Sea East Wind Park, and the second converter platform is Helwin Beta built for Amrumbank West.

In the converter stations, the 155-kV ac voltage will be stepped up and converted into dc using Siemens HVDC Plus system. The power will then be transmitted at a voltage of ±320 kV via submarine high-voltage cables from the feed-in point on the platform to the grid connection point in Buttel, northwest of the city of Hamburg, located at a distance of over 130 km. A special feature of the HelWin Beta offshore converter platform is that it will be connected via a bridge to its parent platform HelWin Alpha to allow

Shewarega et al.: Offshore Wind Power Generation Technologies

Fig. 16. German Transmission Code fault ride through requirement.

shared use of the helicopter deck and crew quarters. There will also be an ac cable link to the bus bar of the platform's 155-kV switchgear and a link to the emergency power system. The HVDC VSC grid connection has a rating of 690 MW and is scheduled to be operational by 2015.

VII. GRID INTEGRATION AND GRID CODE REQUIREMENTS

As a result of the rapid increase in renewable-based electricity generation, a number of transmission system operators issued grid codes imposing specific requirements concerning grid support during steady-state operation as well as grid faults [15], [16]. First among these requirements is one which stipulates that wind turbines have to remain connected during fault and provide support.

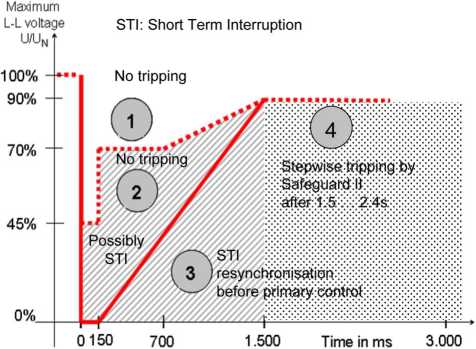

Fig. 16 summarizes the requirement by the German E. ON Transmission Code. In the region marked "1" tripping is not allowed at all. A Short-Term soft Interruption (STI; e.g., converter blocking due to overcurrent) is permitted in region 2, if this is required by the generator concept and a resynchronization within a certain time can be guaranteed. Additionally, the provision of reactive power by the LSC or other equipment has to be ensured during the interruption. In area 3, an STI is allowed for all types of power generation units and the resynchronization time can be higher than 2 s. Even in area 4, the units have to stay connected and can only be tripped by the higher level supervisory grid protection (Safeguard II).

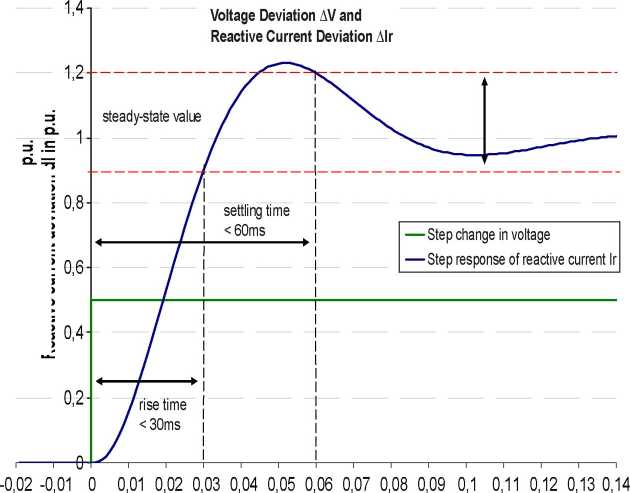

During grid faults the reactive current control of the wind turbines must be utilized to support the grid voltage. Modern protection devices clear the fault normally in a range of 100-150 ms or less following a fault. However, this time window may be decisive for the stability of the grid and, consequently, for the whole system. The new German renewable energy law includes new regulations concerning ancillary services by specifying the reactive current to be injected into the system depending on the voltage deviation. Fig. 17 shows the required reactive current injection as a function of time for a step voltage dip of 50%. In addition to the dynamic response, as specified in

p 110刀>§waurl。©>*8£ .E>p u£e>ep efoA

time in s

Fig. 17. Voltage support requirements as per German renewable energy law.

Shewarega et al.: Offshore Wind Power Generation Technologies

-50%

Dead band around reference voltage

Additional reactive current

Continuation of voltage control after return into dead zone at least about 500 ms

Reactive_current/voltage gain: k=AlQ/AU > 2.0 p.u.

Within dead band, e.g. const, power factor control

Voltage AU/UN

Rise time < 20 ms

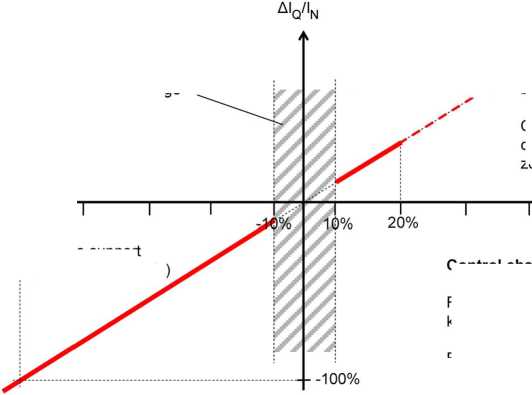

Fig. 18. Reactive current injection as a function of voltage deviation.

Voltage limitation / Activation of voltage control (under-excited mode) by exceeding dead band

Voltage support (over-excited mode)

Control characteristics

Maximum available reactive current lQ max = lN

Fig. 17, the absolute value of the reactive current as a function of the voltage dip (as per Fig. 18) must be fulfilled. Compliance with these provisions of the grid code must be certified before wind turbines are allowed to connect to the grid.

VIII. CONCLUSION

Offshore wind farm technology has experienced a major transformation in terms of both the level of installed capacity and the technological maturity. All indications are that there is a further significant growth potential in the years ahead. In this paper, the current state of the technology and the major challenges faced by the industry with emphasis on turbine control, the collector network, and the transmission link to the grid onshore have been surveyed.

Alternative topologies for the collector network, standard transformer types for the generator, the main substation at the collector bus, and options for reactive power compensation both at medium- and high-voltage levels have been discussed. If instead of the more common radial

REFERENCES

[1] Bundesverband WindEnergie (BWE). [Online]. Available: http://www. wind-energie.de/

[2] European Wind Energy Association (EWEA).

[Online]. Available: http://www.ewea.org/ index.php?id=203

[3] Deutsche Energie-Agentur (DENA). [Online].

Available: http://www.offshore-wind.de/ page/index.php?id=12187&L=1

[4] C. Feltes, H. Wrede, and I. Erlich, ‘'Dynamic behaviour of DFIG-based wind turbines connection a loop structure for the wind farm collector network is used, some of the turbines can be kept operational in the event of internal faults. However, the design and coordination of the protection system against internal faults becomes more challenging.

during grid faults,’’ IEEJ Trans. Ind. Appl., vol. 128, no. 4, pp. 396-401, 2008.

[5] C. Feltes, S. Engelhardt, J. Kretschmann, J. Fortmann, F. Koch, and I. Erlich, ‘‘High voltage ride-through of DFIG-based wind turbines,’’ in Proc. IEEE Power Energy Soc. General Meeting, Jul. 20-24, 2008, DOI: 10. 1109/PES.2008.4596803.

[6] I. Arana, A. Hernandez, G. Thumm, and J. Holboell, ‘‘Energization of wind turbine transformers with an auxiliary generator in a large offshore wind farm during islanded

The design of offshore foundations both for the turbine and the platform together with the choice of the material used for the support structure has been reviewed. The dimensions involved in the design of the platform which accommodates the main transformer, the compensation reactors, and other equipment, have been illustrated using data from practical applications.

Comparison of the various transmission options for linking up the offshore wind farm to the grid onshore was the next issue of interest. AC connections are the most commonly used interconnection method for offshore wind parks at this point in time. However, the constraints regarding the transmission voltage level may tilt the choice in favor of HVDC in the future. The paper finally concludes by discussing the grid code requirements which the wind farms are required to fulfill both in steady state and during a contingency. ■

operation,’’ IEEE Trans. Power Delivery, vol. 26, no. 4, pp. 2792-2800, Oct. 2011.

[7] I. Erlich, J. Kretschmann,

S. Muller-Engelhardt, F. Koch, and

J. Fortmann, ‘'Modeling of wind turbines based on doubly-fed induction generators for power system stability studies,,, in Proc. IEEE Power Energy Soc. General Meeting, Pittsburgh, PA, Jul. 2008, DOI: 10.1109/PES.2008.

4596271.

[8] R. Pena, J. C. Clare, and G. M. Asher, ‘‘Doubly fed induction generator using back-to-back PWM converters and its application to

I Journal of

^0/^^^ Marine Science and Engineering

Offshore Wind Power Integration into Future Power Systems: Overview and Trends

Ana Fernandez-Guillamon 1,+©z Kaushik Das 2,+© and Nicolaos A. Cutululis 2,+ and Angel Molina-Garcia 1,+z*©

1 Department of Electrical Eng, Universidad Politecnica de Cartagena, 30202 Cartagena, Spain; ana.fernandez@upct.es

2 Department of Wind Energy, Technical University of Denmark, 4000 Roskilde, Denmark; kdas@dtu.dk (K.D.); niac@dtu.dk (N.A.C.)

* Correspondence: angel.molina@upct.es; Tel.: +34-968-32-5462 十 These authors contributed equally to this work.

©check for updates

Abstract: Nowadays, wind is considered as a remarkable renewable energy source to be implemented in power systems. Most wind power plant experiences have been based on onshore installations, as they are considered as a mature technological solution by the electricity sector. However, future power scenarios and roadmaps promote offshore power plants as an alternative and additional power generation source, especially in some regions such as the North and Baltic seas. According to this framework, the present paper discusses and reviews trends and perspectives of offshore wind power plants for massive offshore wind power integration into future power systems. Different offshore trends, including turbine capacity, wind power plant capacity as well as water depth and distance from the shore, are discussed. In addition, electrical transmission high voltage alternating current (HVAC) and high voltage direct current (HVDC) solutions are described by considering the advantages and technical limitations of these alternatives. Several future advancements focused on increasing the offshore wind energy capacity currently under analysis are also included in the paper.

Keywords: offshore wind energy; HVAC; HVDC; P2X; hydrogen storage; CAES

Energy demand has been increasing non-stop during the last decades [1]. Nowadays, fossil fuel sources (i.e., coal, oil and natural gas) provide around 85% of the world energy demand, according to the BP Energy Outlook of 2019 [2]. However, with the Paris climate agreement established in December 2015, this energy scenario is about to change [3]. This climate agreement aims to restrict maximum increase in the global average temperature below 2 ℃ above pre-industrial levels [4]. To fulfill this goal, greenhouse gas (GHG) emission trends should drastically change [5]. Consequently, the use of fossil fuels should be reduced, as they are considered as the main source of GHG emissions [6]. Actually, global GHG emissions are dominated by the emissions of CO2 due to the combustion of fossil fuels, which has been increasing continuously since 1990 [7]. The power sector should be decarbonized by 2050 to meet the Paris agreement target [8]. Furthermore, Liddle and Sadorsky estimated that increasing by 1% the share of non-fossil fuel electricity generation can reduce by up to 0.82% the CO2 emissions [9]. This environmental worry is one of the reasons to promote the integration of renewable energy sources (RES) into power systems [10]. Moreover, RES can also mitigate the energy dependence on fossil fuels imported from other countries [11]. Apart from the economic costs of these fossil fuel imports, decreasing energy dependence increases electricity supply security [12]. The International Energy Agency defines electricity supply security as the uninterrupted availability

of energy sources at an affordable price [13]. However, political stability, market liberalization and foreign affairs are nowadays linked to energy supply security [14]. As a consequence, it is important to be energy-independent to guarantee the energy security of a country [15].

While RES provide an acceptable solution for these two problems, they also face many challenges as their integration increases into the grids, mostly based on their intermittency, variability and uncertainty due to their dependency on weather conditions [16]. Actually, they are usually considered as ‘non-dispatchable’ sources [17]. This fact makes them hard to integrate into power systems [18], as transmission system operators (TSOs) have to deal with not only the uncontrollable demand but also uncontrollable generation [19,20]. RES include bioenergy, geothermal energy, hydropower, ocean energy (tide and wave), PV, thermal solar energy and wind energy (onshore and offshore) [21]. Some of them (such as wind and solar installations) are connected to the grid through power electronic converters, reducing the rotational inertia of the system as they replace conventional generation units [22,23]. This fact compromises the frequency stability and alters the transient response [24]. As a result, several frequency control strategies have been proposed in the specific literature [25-30]. Other alternatives to increase the RES share in power systems and avoid the aforementioned problems are to complement one source with another (for instance, wind with solar and/or hydropower) [31-33] or to use storage systems (such as flywheels, pumped hydroelectric storage, batteries, hydrogen, etc.) [34,35].

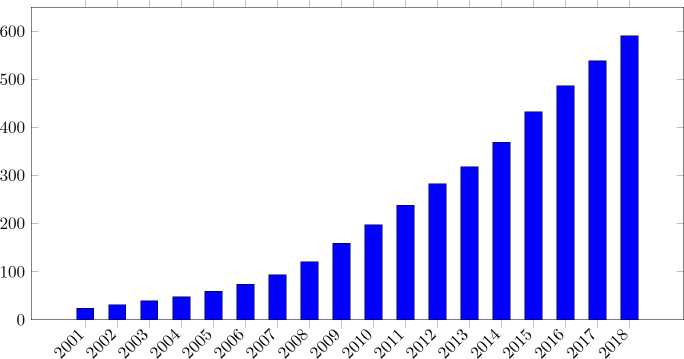

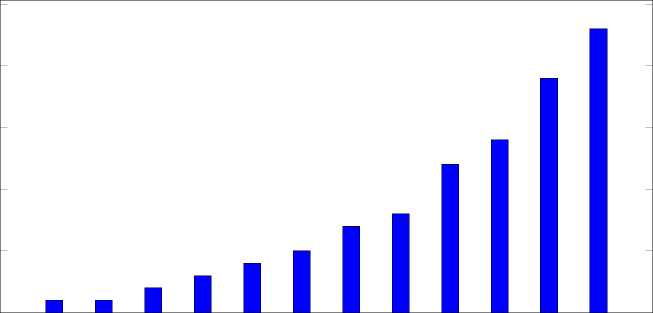

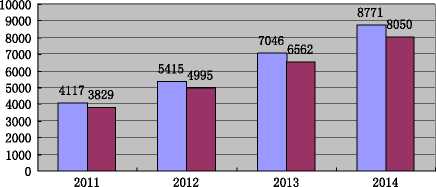

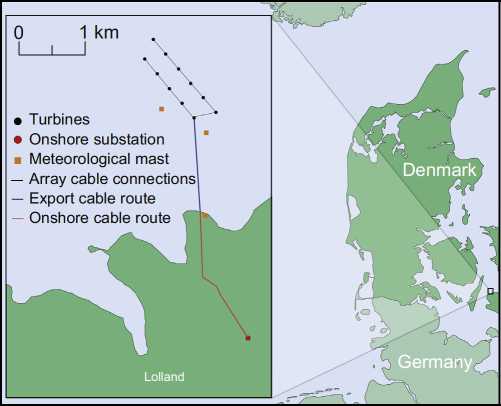

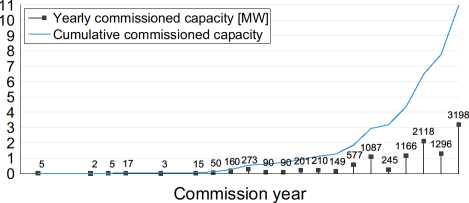

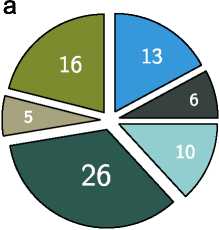

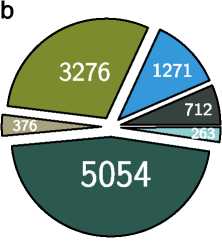

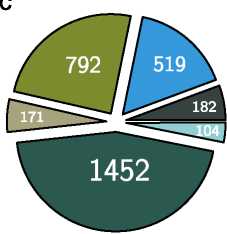

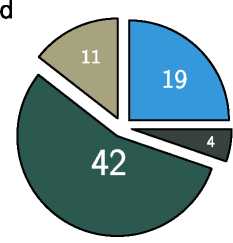

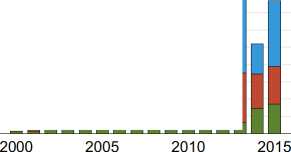

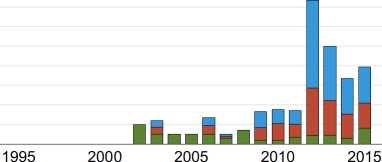

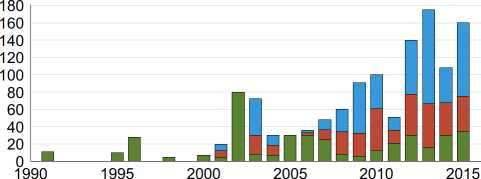

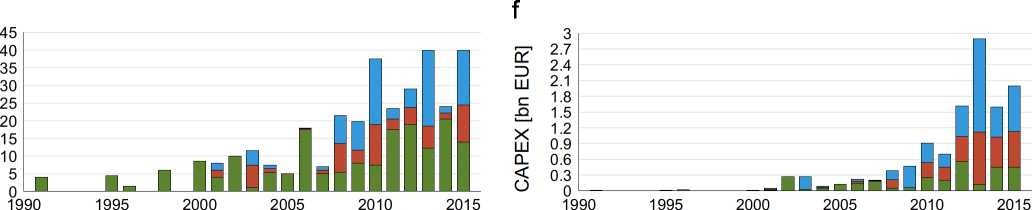

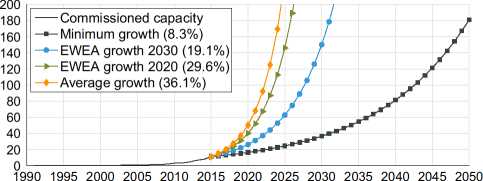

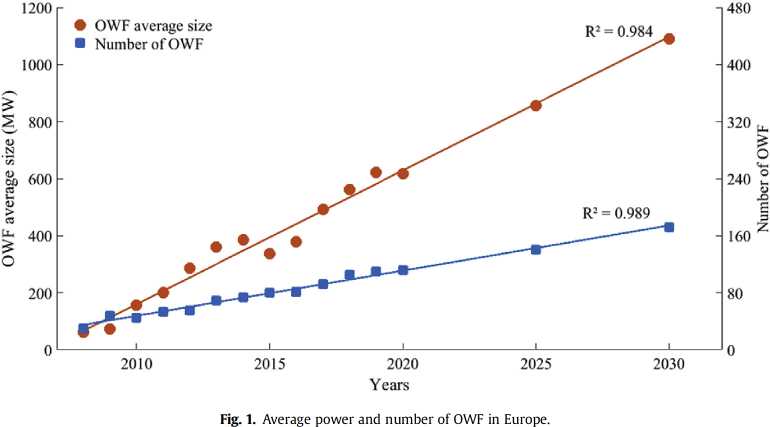

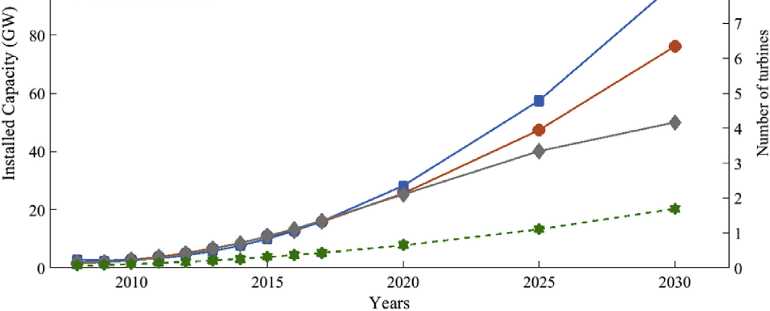

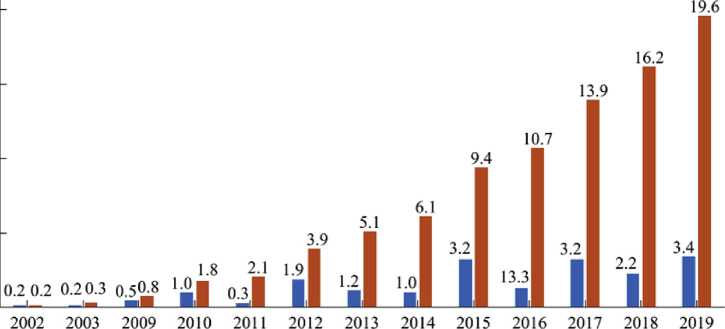

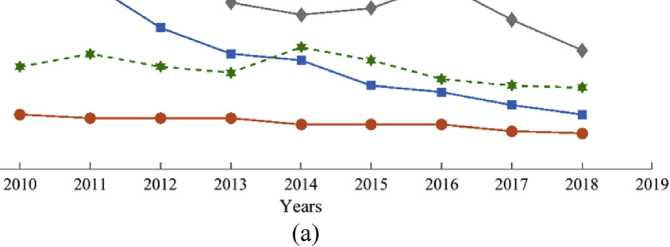

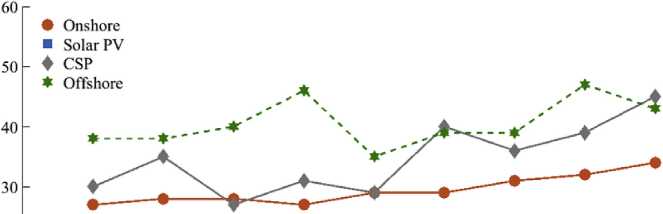

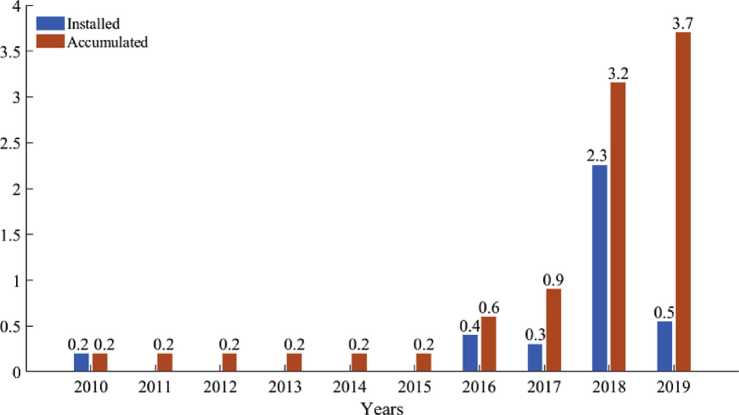

Among these renewable technologies, wind is one of the most economic, prominent and matured RES technologies [36,37]. In fact, since 2001, global cumulative installed wind capacity has shown an exponential growth, as can be seen in Figure 1a. Among the total wind capacity, 23 GW came from offshore installations in 2018, compared to 1 GW in 2007, refer to Figure 1b [38]. Despite offshore wind energy dating back to the 1990s, its popularity started around ten years ago [39]. This increase is due to the current interest of the wind energy industry in offshore wind power [40]. For instance, offshore wind energy investments surpassed onshore investments in Europe in 2016, as presented in [41]. Moreover, nearly 40% of the total wind capacity is expected to come from offshore wind energy in Europe in 2030 [42,43].

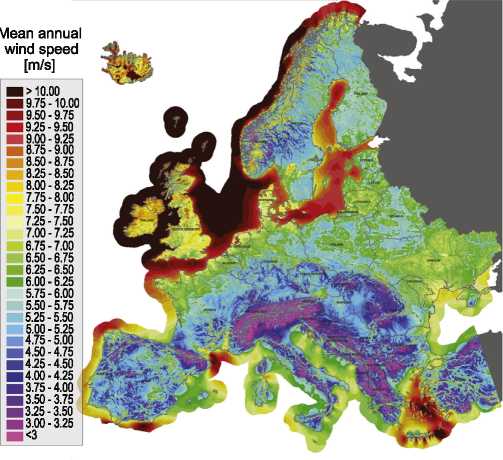

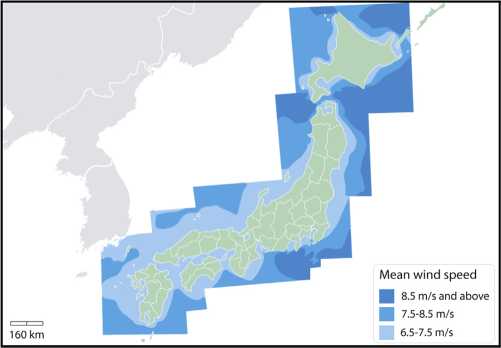

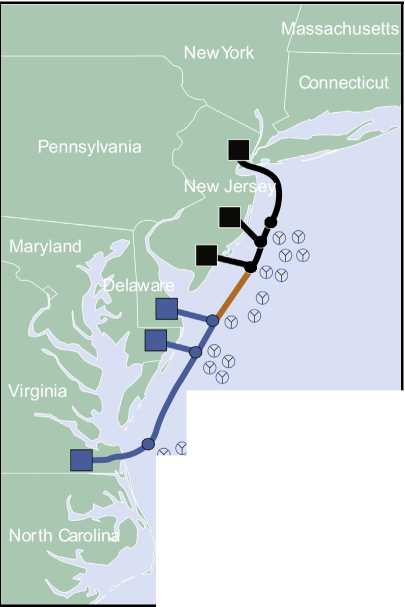

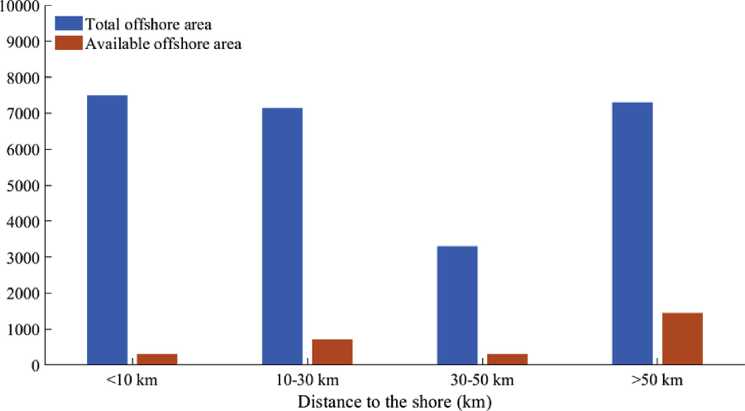

In addition, offshore wind energy presents many advantages compared to onshore wind power plants, especially related to wind energy potential [44,45]: (i) Offshore mean wind speeds are higher and wind power variability is also lower than onshore wind power; (ii) their visual and acoustic impact is usually lower than onshore; subsequently (iii) larger wind turbines (WTs) can be installed [46]. Actually, on the European coasts, the available offshore wind energy is about 350 GW [47]; the USA’s shores present an offshore wind power potential of more than 2000 GW [48]; the offshore wind resource in China is about 500 GW in water depth under 50 m [49]; and the east and west Indian coasts have an offshore wind potential of 4.4 GW and 6.7 GW, respectively [50].

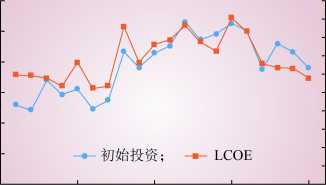

Furthermore, offshore wind speed usually increases with distance from the shore, thus increasing the power generated, as it depends on the cube of the wind speed [51]. However, higher installation and maintenance costs of offshore wind power plants (OWPP) far from the shore balance the benefits of higher energy production [52]. Indeed, OWPP are around 50% more expensive than onshore wind power plants [53], but their costs are expected to decline up to 35% by 2025 [54]. The global weighted average levelized cost of energy (LCOE) in 2018 was 20% lower than in 2010. These cost reductions can be a result of [55]:

• The evolution in wind turbine technology, installation and logistics

• The economies of scale in operations and maintenance

• The improved capacity factors due to higher hub heights, better wind resources and larger rotor diameters

This paper analyzes and reviews different aspects of offshore wind power plants, including several future alternatives to increase the offshore wind power capacity. The rest of the paper is organized as follows: Section 2 presents the current status of offshore wind power plants (WTs and OWPP sizes,

water depth, distance from shore and electrical transmission to shore). Future advancements possible for larger offshore wind power plant integration are analyzed in Section 3. Finally, Section 4 gives the conclusions.

(M°)-loBdB。PHM P-IB+SH OA--nrnn。

25

20

15

10

5

Figure 1. Global cumulative wind capacity in GW. (a) Global cumulative wind capacity: Onshore and offshore. (b) Global cumulative offshore wind capacity.

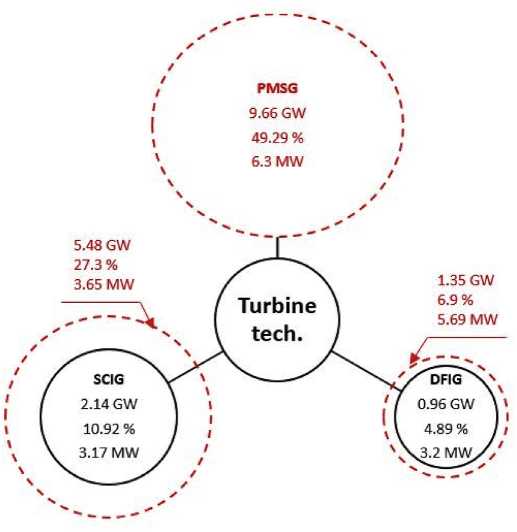

WTs are usually classified as fixed speed wind turbines (FSWTs) and variable speed wind turbines (VSWTs) [56]. FSWTs work at the same rotational speed regardless of the wind speed [57]. VSWTs can operate around their optimum power point for each wind speed, using a partial or full additional power converter [58]. As a result, VSWTs are more efficient than FSWTs [59]. Moreover, WTs present different topologies depending on their generator [60]: type 1 includes a squirrel cage induction generator; type 2 includes a wound rotor induction generator; type 3 includes a doubly-fed induction generator (DFIG); and type 4 includes a full-converter synchronous generator [61]. Types 1 and 2 are FSWTs, whereas types 3 and 4 are VSWTs.

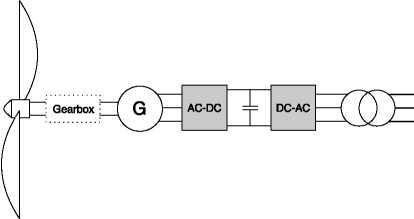

Nowadays, VSWTs are the most commonly installed WTs [62-65]. Among them, full converter generator WTs seem to be a better option than DFIG-based WTs for OWPP [66-72]. The main differences between DFIG and full-converter WTs are the following:

The DFIG configuration needs a gearbox, generator and partial-scale power converter (around 30%), as shown in Figure 2a. The gearbox couples the blades with the generator, increasing the rotational speed from the rotor hub to the induction machine [73-75]. The stator is directly connected to the grid, whereas the rotor is connected to the power converter [76]. As a result, the converter only covers the power produced by the rotor of the DFIG [77].

The synchronous generator of a full-converter WT is excited by an external DC source or by permanent magnets [78]. In this case, the hole generator is connected to the grid through a power converter [79]. Hence, all the generated power from a WT can be regulated accordingly [80]. They have low maintenance costs and negligible rotor losses [81]. Moreover, some type 4 WTs have no gearbox, as depicted with a dotted line in Figure 2b, using a direct driven multipole generator [82].

(a)

(b)

Figure 2. Variable speed wind turbines types. (a) Doubly-fed induction generator (DFIG) wind turbine. (b) Full-converter wind turbine.

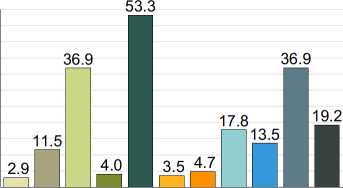

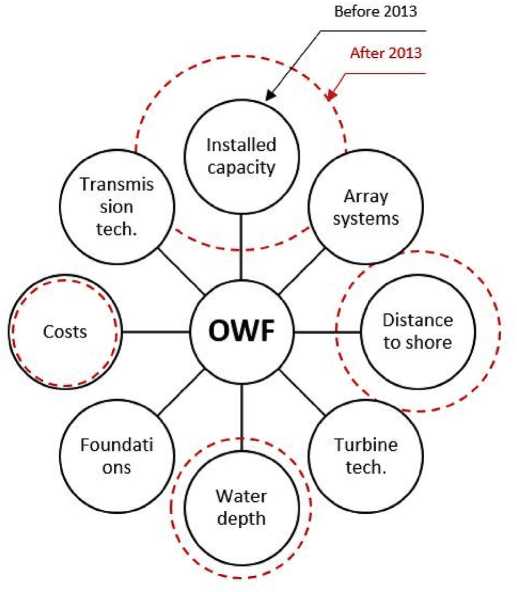

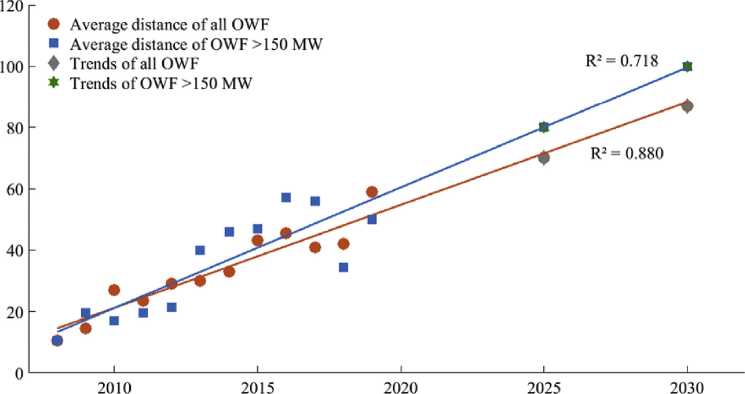

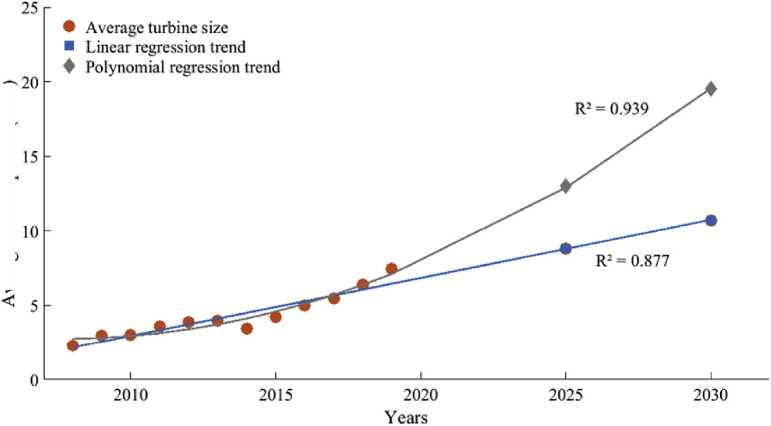

2.2. Offshore Trends: Turbine Capacity, Wind Power Plant Capacity, Depth and Distancefrom the Shore

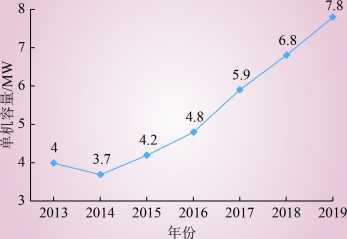

In Europe, the rated capacity of offshore WTs has been continuously increasing during the last decade. For instance, in 2017, the average rated capacity of WTs was 5.9 MW, compared to 3 MW in 2010 and 4.8 MW in 2016 [83]. In 2018, new offshore WTs were 6.8 MW on average, 15% larger than in 2017. Comparing 2018 to 2010, the average WT increase is more than 200%. Moreover, two 8.8 MW offshore WTs were installed in the United Kingdom in 2018, those being the largest WTs installed of the world. The commercial model of those WTs was V164-8.8 MW from MHI Vestas Offshore [84]. However, nowadays there are larger commercial offshore WTs, up to 12 MW, as presented in [85]. Table 1 shows the 10 largest WTs currently available. All of them have a rated power over 8 MW, rotor diameters between 150 and 200 m and are equipped with synchronous generators (type 4).

Table 1. Biggest wind turbines currently available.

|

Rated Power (MW) |

Manufacturer |

Reference |

Diameter (m) |

Generator |

|

8.0 |

Siemens Gamesa |

SG 8.0-167 DD |

167 |

Synchronous permanent |

|

8.3 |

MHI Vestas Offshore |

V164-8.3 MW |

164 |

Synchronous permanent |

|

8.8 |

MHI Vestas Offshore |

V164-8.8 MW |

164 |

Synchronous permanent |

|

9.0 |

MHI Vestas Offshore |

V164-9.0 MW |

164 |

Synchronous permanent |

|

9.5 |

MHI Vestas Offshore |

V164-9.5 MW |

164 |

Permanent magnet |

|

10.0 |

AMSC |

wt10000dd SeaTitan |

190 |

HTS synchronous |

|

10.0 |

MHI Vestas Offshore |

V164-10.0MW |

164 |

Permanent magnet |

|

YZ150/10.0 |

150 | |||

|

10.0 |

Swiss Electric |

YZ170/10.0 |

170 |

Synchronous permanent |

|

YZ190/10.0 |

190 | |||

|

10.0 |

Siemens Gamesa |

SG 10.0-193 DD |

193 |

Synchronous permanent |

|

12.0 |

General Electric |

GE HALIADE-X |

220 |

Synchronous permanent |

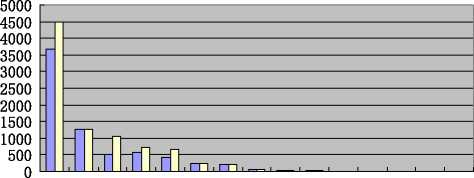

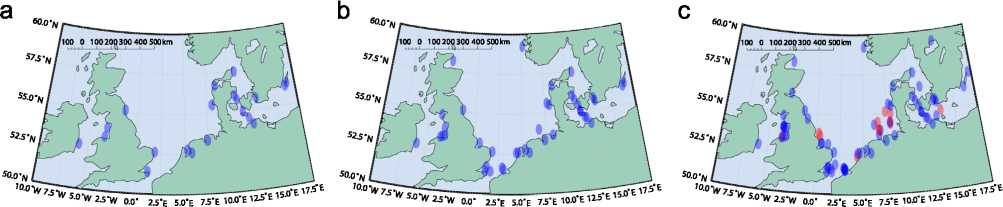

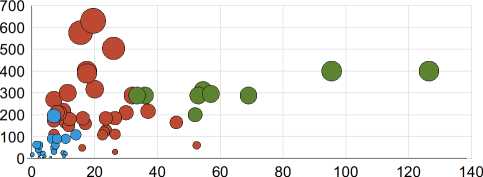

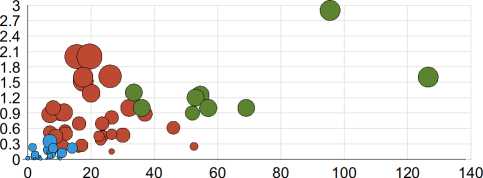

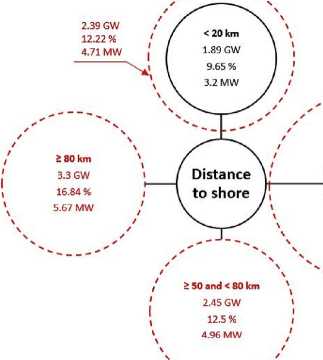

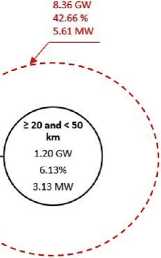

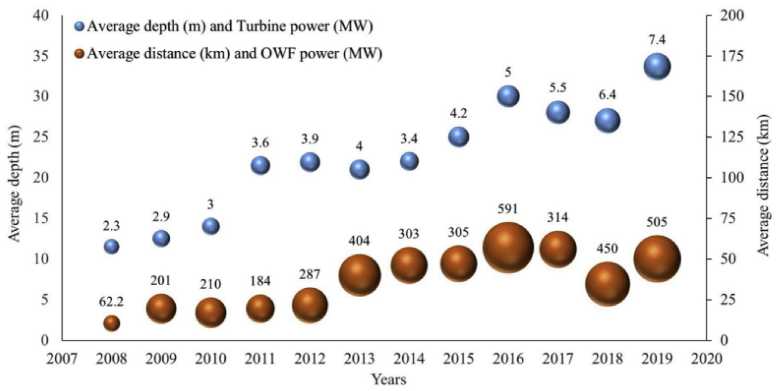

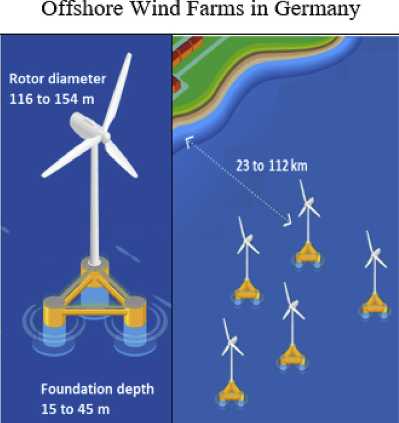

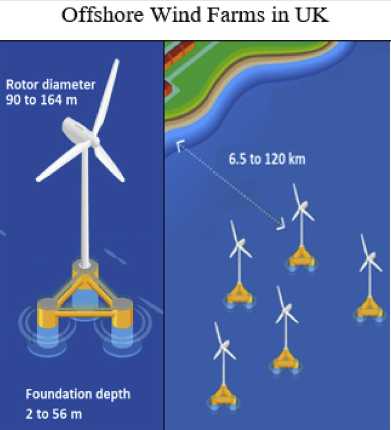

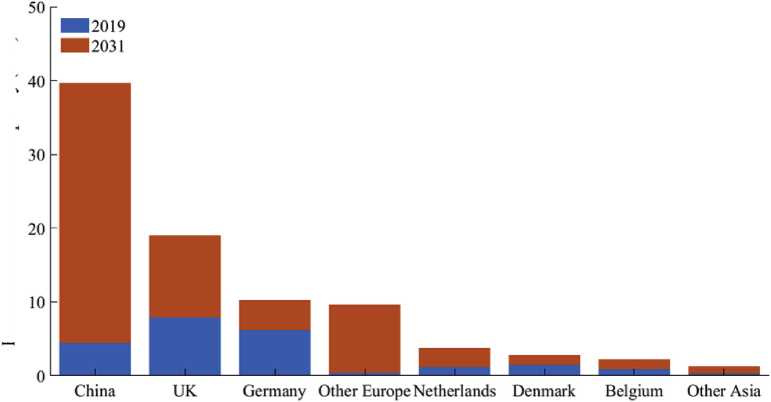

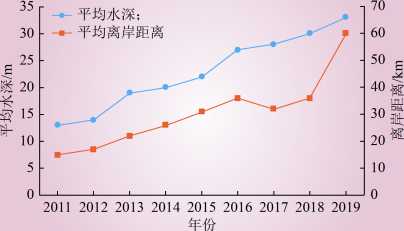

Regarding OWPP capacity, it has also increased dramatically in the last 10 years (around 700%), in line with the increase of average offshore WT capacity. In fact, average OWPP capacity was 79.6 MW in 2007. In contrast, 561 MW was the average capacity for OWPPs in 2018 [84]. This means that considering the average WT and OWPP capacities of the year 2018, each OWPP has between 80 and 85 WTs. On the other hand, OWPP depth and distance to the shore have not increased that much in recent years. At the end of 2013, the average water depth of OWPPs was 16 m with an average distance to the shore of 29 km [86]. In 2018, the average water depth of OWPPs under construction was 27.1 m, with an average distance to shore of 33 km. This means that water depth has increased by 170% and distance to shore by around 110%. There are some OWPPs that should be mentioned: Hornsea One (UK) and EnBW Hohe See (Germany) are the OWPPs located farthest from the shore (103 km away); Kincardine Pilot (Scotland), a floating demonstration project, has a water depth of 77 m [84]; and Hywind (Scotland), the first fully operational floating wind farm, with water depths varying between 95 and 129 m [87].

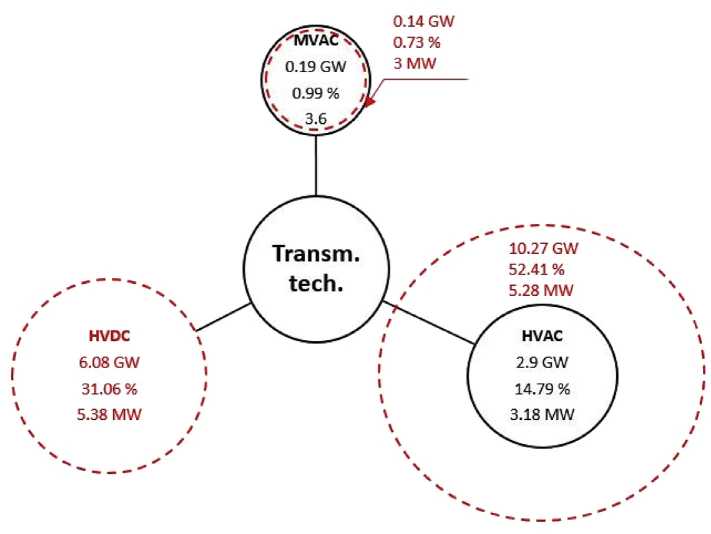

2.3. Offshore Wind Power Electrical Power Transmission

For the electrical power transmission from the OWPP plant to the shore, there are two possibilities: (i) High voltage alternating current (HVAC) and (ii) high voltage direct current (HVDC). Figure 3 depicts an overview of the current state of offshore wind power energy transmission to the shore.

(HVAC

(lcC HVDcJ VSC

(DRU

Figure 3. Offshore wind power plant transmission.

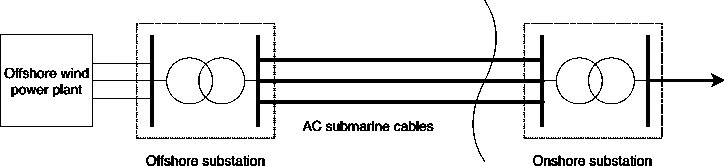

2.3.1. High Voltage AC

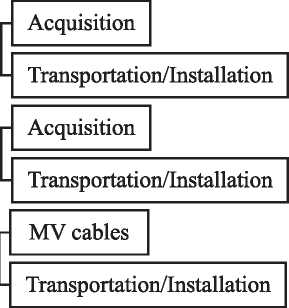

HVAC transmissions were mostly used for OWPPs until the year 2010 [88]. Their easy protection system design and the use of transformers to change between different voltage levels were the main reasons to use them [89]. However, the high capacitance of submarine HVAC cables combined with the low resistivity of sea water caused different electromagnetic dynamic and transient problems from those of conventional overhead lines, such as distortion of the voltage’s shape due to resonance problems [90,91]. This high capacitance also leads to substantial charging currents, subsequently reducing the active power transmission capacity and transmitting reactive power in long distances [92]. A possible solution could be to install reactive power compensation units along the HVAC submarine cables, but they are expensive devices and it is a difficult task to carry out [93]. an alternative found in the literature is to add compensation units only at both ends (onshore and offshore) of the underwater cables, which improve the current profile along them [94,95]. However, their effect is very limited for distances over 60-75 km [96,97]. With the aforementioned considerations, the topology for HVAC transmission from OWPPs is depicted in Figure 4 [98,99]. It consists of:

• An offshore substation to increase the offshore voltage level (usually from 30-36 kV) to the transmission voltage level at 132-400 kV.

• Three-core HVAC submarine transmission cables.

• Reactive compensation units on both ends (offshore and onshore), such as static VAR compensators (SVCs) or static synchronous compensators (STATCOMs).

• An onshore substation, if the onshore interconnecting grid voltage is different from the offshore transmission system rated voltage.

Shore line

HV transformer & compensation HV transformer & compensation

Figure 4. Offshore wind power plant high voltage alternating current (HVAC) transmission system.

As can be seen, the OWPP grid is synchronously coupled to the main onshore grid. This is another problem of HVAC links for OWPPs, as all faults in either the grid or the OWPP are propagated to the other one [100].

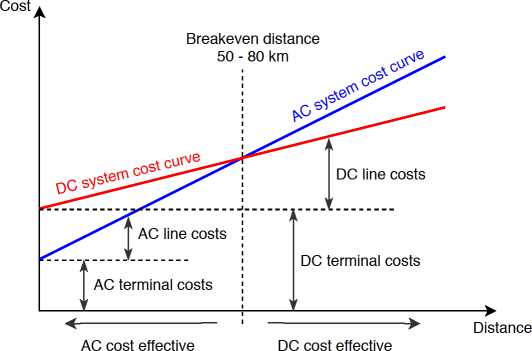

2.3.2. High Voltage DC

High voltage direct current (HVDC) transmission is considered as the best solution to OWPPs located far away from the land [101]. Actually, some studies conclude that HVDC links are economically viable for distances above 50-70 km [102]. A graphical comparison of costs between HVAC and HVDC transmission systems can be seen in Figure 5 [103].

Figure 5. AC and DC system costs based on the transmission distances.

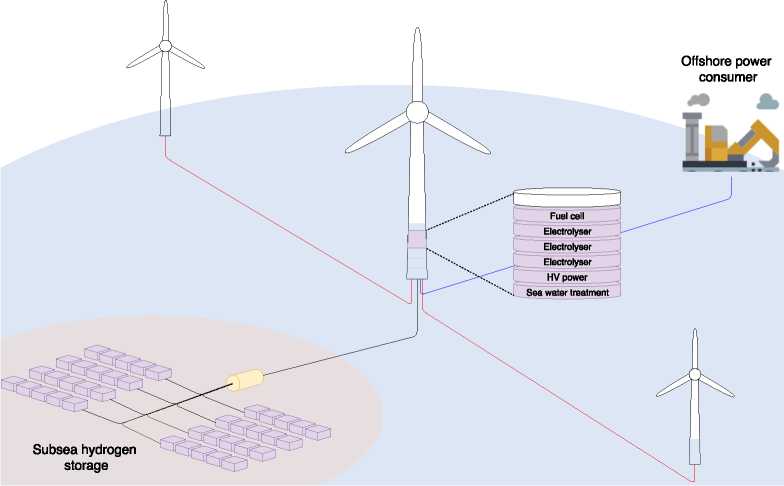

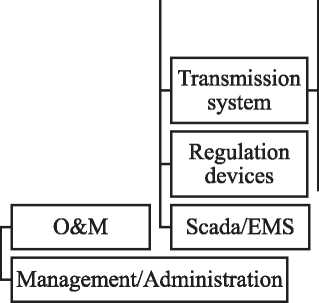

Figure 6 shows the main elements of an HVDC connection, and consists of [104,105]:

• An offshore substation to increase the voltage level to the level of the transmission line.

• AC/DC rectifier.

• AC and DC filters to cancel the low order harmonics. Furthermore, the AC filters supply some of the reactive power used by the converter, whereas the DC filters avoid the generation of circulating AC currents in the cable.

• DC current filtering reactance. This removes the possibility of a current interruption under minimum load circumstances, limiting DC fault currents and also reducing current harmonics in the DC cable.

• DC cables.

• DC/AC converter.

• An onshore substation.

Shore line

HV transformer & AC/DC converter DC/AC converter & HV transformer

Figure 6. Offshore wind power plant HVDC transmission system.

In contrast to the HVAC topology presented in Figure 4, the HVDC link electrically decouples both the OWPP and the onshore grid, avoiding the propagation of possible disturbances between them [106,107].

Two different HVDC technologies are currently under use: Line-commutated converters (LCCs) based on thyristors and voltage-source converters (VSCs) based on insulated gate bipolar transistors (IGBTs) [108]. Among them, there is not a clear consensus about which technology is better: Some authors consider that LCCs are superior to VSCs in terms of reliability, cost and efficiency [26], whereas others affirm that the VCS-HVDC transmission system is the most promising technology [109]. a comparison between both HVDC technologies is summarized in Table 2 [110]. Recently, another technology called the diode rectifier unit (DRU) has been under discussion, though has not been implemented yet [111].

Table 2. Comparison between line-commutated converter (LCC) and voltage-source converter (VSC) HVDC technologies.

|

Technology |

LCCs |

VSCs |

|

Semiconductor |

Thyristor |

IGBT |

|

Control |

Turn on |

Turn on/off |

|

Power control |

Active |

Active & Reactive |

|

AC filters |

Yes |

No |

|

Blackstart capability |

No |

Yes |

Line-Commutated Converters

Traditionally, HVDC transmission systems have been based on LCCs, which use thyristors as the base technology. Actually, LCC is a trusted and mature technology [112] that links a mainland with some islands (e.g., in Northern Europe [113]). However, solutions based on thyristors usually involve the injection of some harmonics. For example, a twelve-pulse thyristor bridge, which is made up of two six-pulse bridges; the fifth and seventh harmonics can be canceled [114]. The LCC-HVDC transmission system is based on this twelve-step bridge [115,116].

The main drawbacks of the LCC-HVDC link are [116-120]:

• It can only transfer power between (at least) two active grids. As a result, an auxiliary start-up system is necessary in the OWPP.

• It demands reactive power, which needs to be supplied through reactive support devices.

• Despite most harmonics being canceled by using a twelve-pulse bridge, others still remain, thus needing additional filters.

• It requires voltage support for the OWPP AC bus. Two possible solutions can be found to overcome this requirement: (i) Installing a dedicated STATCOM, which increases considerably the overall cost or (ii) controlling the turbine inverters individually, which is technically challenging.

• The inverter is susceptible to commutation failures, especially when connected to weak AC power systems.

Blasco et al. suggest that the filter’s design depends on the harmonic characteristics of the AC grid and the active power exchanged by the LCC-HVDC link, thus needing a detailed AC power system analysis [121].

Voltage-Source Converters

Since 2005, VSC-HVDC technology has been used in offshore applications. It is based on IGBTs [122]. The main characteristics of the VSC-HVDC link are summarized as [123-125]:

• It can control active and reactive power simultaneously.

• It can feed island-mode, weak AC and passive networks.

• Its station requires less space than that of an LCC (about 60% less).

• The cables are lighter.

• It does not require reactive power compensation.

• It can transmit power from zero to full-rating bidirectional, enabling OWPP start-up (black start operation) and working at low wind speeds.

Despite all these advantages, VSC-HVDC presents higher commutation losses and costs compared to the LCC-HVDC. Moreover, it can only handle limited voltage and power levels [126].

Diode Rectifier Unit

During the last years, DRU-HVDC has been under discussion. A DRU includes several diodes, a transformer and a smoothing reactor [127]. As DRU can only convert AC to DC [128], a hybrid topology combining DRU and VSC/LCC must be used, introducing the DRU as the offshore rectifier and the LCC/VSC as the onshore converter [129]. The main advantages of DRU-HVDC compared to LCC-HVDC and VSC-HVDC are [130-133]:

• Reduction of volume (80%) and weight (66%) of the platform.

• Smaller footprints.

• Reduction of power losses up to 20%.

• Reduction of total cost up to 30%.

• Capacity increased by 33%.

• Higher reliability and efficiency.

• Modular design and full encapsulation.

• Reduced operation and maintenance costs.

However, several problems have to be solved before implementing a DRU-HVDC connection [132-135]:

• As the DRU is a non-controllable passive device, the OWPP AC system must be regulated and controlled by the WT, thus requiring different WT and OWPP schemes.

• The onshore converter (LCC/VSC) controls the HVDC voltage. Subsequently, the DRU output DC voltage must be higher than the minimum voltage value to start conducting and transmit the power to the onshore station.

• Passive filters or active compensation devices are needed to remove the harmonic currents injected by the DRU.

• Voltage and frequency control stages are needed in the offshore grid for DRU commutation.

• A DRU is not able to provide auxiliary active power for the WT and OWPP substation, being then a drawback to the self-start of WTs.

• A DRU is not able to provide reactive power, needing power converters or other devices to compensate it.

In 2018, ENTSO-E and ENTSO-G published their Ten Year Network Development Plan (TYNDP) scenarios. It was the first time that both European electrical and gas TSOs collaborated together. The TYNDP 2018 covers from 2020 to 2040 [136]. In 2030-2040, it is expected that between 45 and 75% of the overall European demand will be covered by RES, especially by hydro, wind and solar power. Actually, in the North Sea and Baltic Sea regions, the offshore wind power capacity is estimated to reach between 40 and 59 GW in 2030, and between 86 and 127 GW in 2040, according to the TYNDP. Other authors propose similar offshore wind power capacity scenarios in these regions; for instance, scenarios were modeled and optimized by Koivisto and Gea-Bermudez [137]. Greenpeace published in 2015 their ‘Energy [Revolution' forecast, where 148 GW of offshore wind capacity is expected to be installed in Europe in 2050 [138]. In the US, the Department of Energy considers that 22 GW of OWPPs can be installed by 2030, increasing up to 86 GW by 2050 [139]; according to the scenarios presented by the Energy Resources Institute of India for 2050, it could have 170 GW installed of offshore wind energy by then [140]; and the Chinese scenarios propose to install 200 GW of OWPPs (150 GW near offshore wind and 50 GW far offshore wind) by 2050 [141,142]. By these means, OWPPs seem to have an important energy role in the future worldwide.

However, onshore wind and other conventional fossil fuel technologies are currently cheaper than offshore wind energy [143]. As a consequence, different alternatives are being researched to reduce further costs of offshore wind power development:

Power-to-X conversion (P2X)

North Sea Wind Power Hub: The Hub-and-Spoke project

Offshore storage options

These initiatives are discussed in detail in the following.

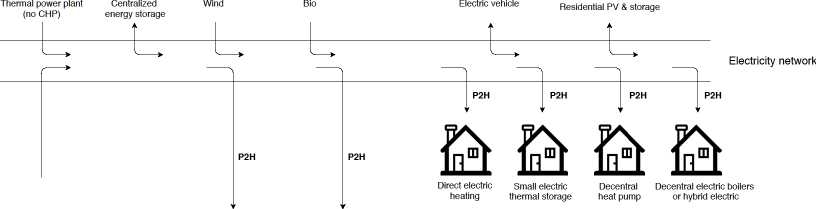

P2X is based on converting power (electricity) to diverse substances (X) [144]. The different alternatives available in the P2X conversion are [145,146]:

Power-to-heat (P2H): The electrical generation excess is linked to a heat device (electric boiler, heat pump), avoiding any intermediate energy carrier and subsequently increasing the global efficiency. Power-to-liquid (P2L): Different alternatives can be found in the specific literature, including the production of syngas through hydrogenation of CO2 and reverse water gas shift; co-electrolysis of CO2 and H2O; or directly through the electro-reduction of CO2 to methanol.

Power-to-chemicals (P2C): From the syngas obtained with the power-to-liquid conversion, several compounds can be produced accordingly.

Power-to-gas (P2G): Hydrogen is obtained from an electrolysis process and the possible subsequent conversion to methane with CO2.

Power-to-mobility (P2M): The electrical generation excess is used by the mobility sector through electric vehicles with an electric motor of 90% efficiency instead of an internal combustion engine (efficiency of 20%) or fuel cell (efficiency of 50%).

Power-to-power (P2P): Electricity is converted into chemical or mechanical energy, which is stored and later reconverted into electric power.

These transformations are expected to be very relevant in future power systems, as the generated electricity excess can be stored in different ways and later used as, for instance, fuel for power plants [147]. Hence, the system’s flexibility would be enhanced [148]. By these means, high capacity P2X plants could increase the RES supply by providing supply security in terms of storage facilities [149]. Moreover, as explained in [150], the P2X conversion provides a real link between different sectors, promoting the transition towards a future urban smart energy system. As an example, Figure 7 depicts